Every pip matters when trading in any market, especially Forex. This comprehensive guide shows how low-spread forex brokers can make a measurable difference to your trading performance. By digging into the spread dynamics, zero-spread account models, and advanced cost analytics, you’ll discover valuable insights and learn how to select a broker that perfectly matches your specific trading strategies!

This article explores each technical aspect in detail, including everything from execution speed and order flow to commission structures and advanced risk management tools.

Understanding Forex Spreads: Definition and Importance

Forex spreads represent the difference between the bid and ask prices, and they are at the very heart of every trading cost. A forex spread is not merely a fee; it is a real-time measure of market liquidity and volatility.

In highly liquid pairs like EUR/USD, the gap is often very narrow, sometimes under one pip, because millions of transactions take place every minute. Conversely, exotic pairs may exhibit wider spreads due to lower trading volumes and higher uncertainty. This variation is critical for traders because a narrower spread reduces the initial cost barrier to entering a trade.

Advanced traders note that spreads can also serve as an indirect indicator of market conditions. For example, during periods of high volatility, even a broker known for consistently narrow spreads may see a temporary widening.

The relationship between market liquidity and spread dynamics is multifaceted; algorithmic trading systems often factor in spread fluctuations as part of their risk models. By using sophisticated forex software to monitor these changes in real time, traders can adjust their strategies promptly.

Overall, the advantage for traders who choose to work with forex brokers with low spreads is clear: lower spreads mean a reduced breakeven point, making every pip count.

The Role of Low Spreads in Forex Trading

Low-spread forex brokers are a cornerstone for cost-efficient trading, especially for high-frequency and scalping strategies. When spreads are minimized, the expense incurred to enter and exit positions is lower.

This is especially important for scalpers who depend on numerous small gains rather than a few large moves. Detailed analyses have demonstrated that reducing the spread by just one pip can result in substantial monthly savings, especially if you execute hundreds of trades. For instance, reducing the spread by one pip on a standard lot can save several hundred dollars monthly over extended trading sessions.

Beyond the immediate cost, narrow spreads directly improve the risk/reward ratio. Lower spreads mean your profit target does not have to cover as much expense, improving overall profitability.

To put it into numbers:

- let’s say a trader is looking to gain 30 pips but is only willing to risk 1 pip through a stop-loss. In this scenario, a wider spread can change the risk dynamics, turning what could be a winning ratio into a scenario that leads to a loss.

Sophisticated trading algorithms incorporate these dynamics into their decision-making models. They evaluate real-time spread fluctuations and execute orders during moments of highest liquidity, further reducing trading costs.

This is why more experienced traders prefer low-spread forex brokers; these brokers help them save on costs, which means they can fine-tune their trading strategies and reduce slippage, leading to tighter execution and an overall better trading performance.

Exploring Zero-Spread Accounts: Benefits and Drawbacks

Zero-spread brokers present an attractive concept by offering no visible gap between the bid and ask, though they recoup costs through commission fees. At first glance, a zero-spread account might appear to provide a flawless trading environment; after all, there is no differential between the bid and ask.

Benefits of Zero-Spread Brokers

- The broker applies a fixed commission per lot traded, allowing for clear cost expectations.

- For traders operating on very high volumes or using automated strategies, zero-spread models can be an option when commissions stay lower than variable spreads during market shifts.

- Under stable market conditions, a commission-based structure can sometimes lead to lower overall expenses compared to a traditional spread-only model.

- Some advanced platforms designed for zero-spread trading offer faster execution times and more transparent order flow.

- Algorithmic traders benefit from steady trading costs and minimal slippage, improving strategy efficiency.

However, they are not perfect:

Drawbacks of Zero-Spread Accounts

The fixed commission model may not always be the most cost-effective choice, especially during volatile market conditions when trading frequency increases.

- Additional charges or unexpected costs can quickly reduce the advantages of zero spreads.

- While spreads are removed, commissions can sometimes result in higher trading costs than variable spread accounts in certain situations.

- Execution speed and order fill quality vary by broker, meaning traders must carefully assess platform reliability.

- Hidden costs or less-favorable trading conditions can offset the savings from zero spreads, making thorough cost analysis necessary.

Impact of Low Spreads on Trading Costs and Profitability

Lower spreads dramatically reduce cumulative trading costs, boosting net profitability over time. To illustrate the impact, consider a scenario where a trader executes 300 trades in a month on a major pair like EUR/USD.

If we can lower the average spread by just 0.5 pips, the savings could add up to hundreds or even thousands of dollars- this varies based on the lot size and leverage used. What’s really interesting is that detailed numerical models show that even slight improvements in spread can result in significant savings when you consider many trades together.

For example:

- Assume a standard lot trade where a 1-pip move equals $10. A reduction from 1.2 pips to 0.7 pips saves 0.5 pips per trade. With 300 trades, that translates to 150 pips saved, or $1,500 in trading costs over the month. This kind of quantitative analysis underscores why low-spread forex brokers are vital for traders who rely on frequent trading.

Plus, the advantages go beyond just saving money. A smaller spread helps lower the initial breakeven point for each trade, which in turn enhances the effective risk/reward ratio. This means traders can set tighter stop-loss orders while still reaching realistic profit targets, which is especially helpful for scalping strategies or trading during quieter market periods.

The relationship between spread costs and overall profitability plays a significant role in determining margin requirements. When you trade with low-spread forex brokers, it helps to protect your margin better, giving you more flexibility in how you manage your capital.

Advanced quantitative models that combine real-time spread data help traders sharpen their strategies. These models take into account the likelihood of spread widening during important news events and adjust order entries and exits accordingly. This way, traders can take advantage of low spreads, even when market conditions change unexpectedly.

Key Features of Low-Spread Forex Brokers

The best low-spread forex brokers offer a sophisticated blend of advanced technology, reliable platforms, and transparent fee structures. Top-tier brokers distinguish themselves by providing a suite of powerful trading platforms that support multiple order types, automated strategies, and integrated charting tools for discovering key chart patterns.

These platforms, often built on widely recognized industry standards, allow traders to execute orders with lightning speed and minimal slippage.

- Comprehensive Real-Time Analytics:

- Advanced forex software tools that allow traders to monitor spread fluctuations, execution speeds, and order fill quality.

- Insights derived from analytics help refine trading algorithms.

- Integration of API access for developing custom applications that analyze spread data in detail.

- Multi-Asset Trading Capability:

- Enables diversification of strategies by engaging with different financial instruments.

- Brokers often offer various account types, such as raw-spread or ECN accounts.

- Traders can choose between commission-based or spread-only pricing models to tailor their cost structures.

- High Security Standards:

- Advanced encryption protocols to protect personal and financial data.

- Segregated client funds for added security.

- Transparent Reporting Tools:

- Provides a clear, comprehensive view of trading expenses.

- Helps traders make informed decisions about broker selection.

- Value-Driven Performance:

- A combination of state-of-the-art technology, efficient order execution, and clarity in fee structures distinguishes truly competitive low-spread forex brokers.

Choosing the perfect low-spread broker goes beyond simply checking out the spreads they advertise. By taking a closer look at execution quality, technology features, and how transparent their pricing is, traders can boost their profitability and keep those extra costs to a minimum.

So, let’s look at some practical tips for choosing a low-spread broker and break down the factors that can help refine your selection process.

Tips for Choosing the Right Low Spread Broker

Selecting a low-spread forex broker requires careful evaluation of multiple factors, including execution quality, cost structure, and platform performance.

- Examine Pricing Models:

- Compare nominal spreads along with any applicable commissions or fees.

- Watch for brokers promoting ultra-low spreads but compensating with high commission rates.

- Use forex spread comparison charts to reveal the true cost per trade across account types.

- Assess the Broker’s Technological Edge:

- Seek platforms offering low-latency execution and robust forex software integrations to minimize slippage.

- Features such as API access, customizable charting, and advanced order types enhance trading flexibility.

- These technological advantages are particularly important for algorithmic and high-frequency traders.

- Test Order Execution Speed:

- Conduct simulated order runs or live demo sessions to gauge execution speed in different market conditions.

- Verify if the broker employs Direct Market Access (DMA) or an ECN (Electronic Communication Network) model, as these typically offer faster, more transparent execution.

- Evaluate Risk Management Tools:

- Review the broker’s margin requirements, liquidity safeguards, and protective features like guaranteed stop-loss orders or negative balance protection.

- Such safeguards help protect your capital during periods of extreme market volatility.

- Review Customer Support and Reporting Tools:

- Opt for brokers with 24/7 customer support and multiple communication channels.

- Transparent reporting tools that offer detailed performance and cost analytics enhance your ability to track and optimize trading expenses.

While this can be meticulous, the good news is that we have already gathered a list of the best low-spread Forex brokers.

Review of the Best Low-Spread Forex Brokers

After a careful evaluation of the lowest-spread Forex brokers out there, these are the ones that offer the most while taking the least:

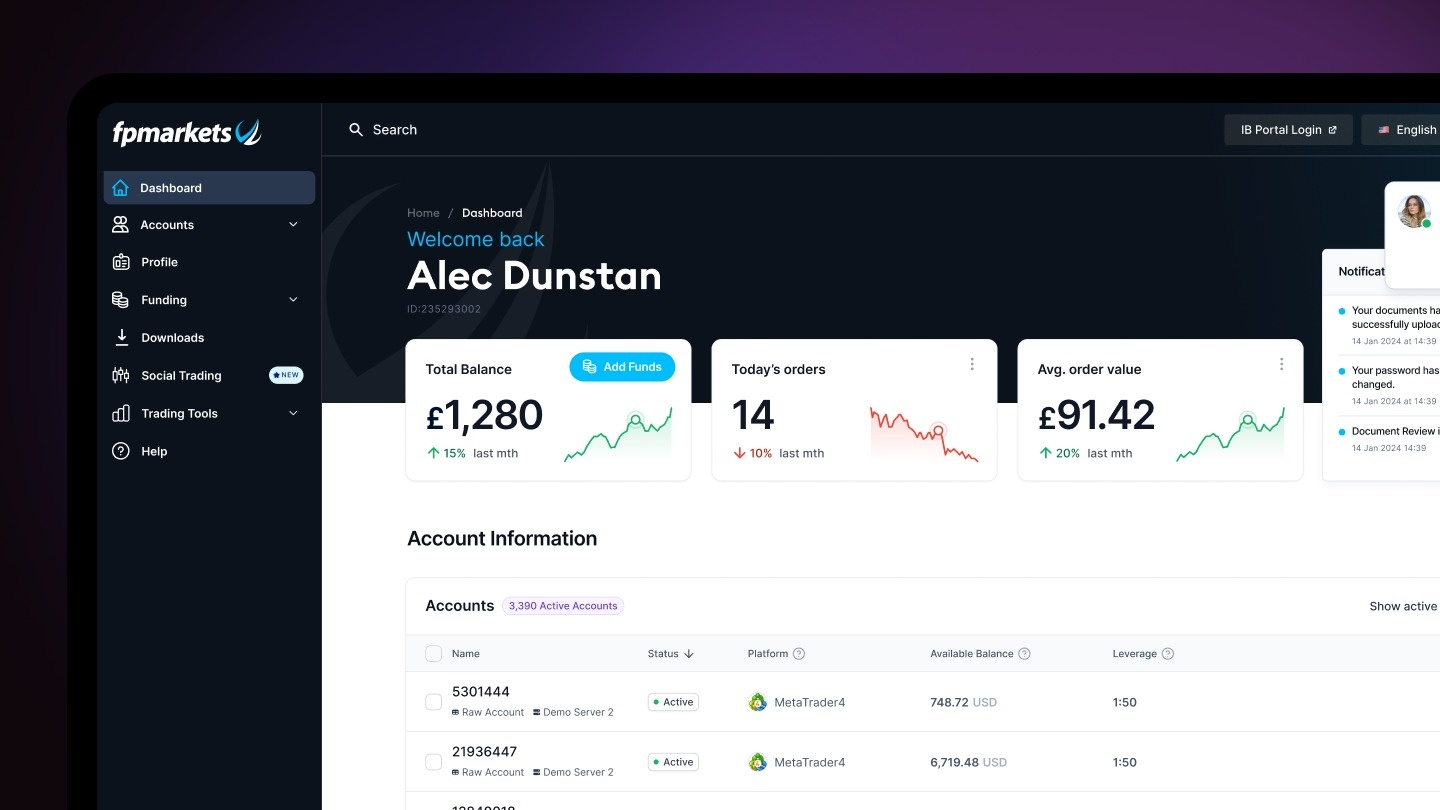

FP Markets

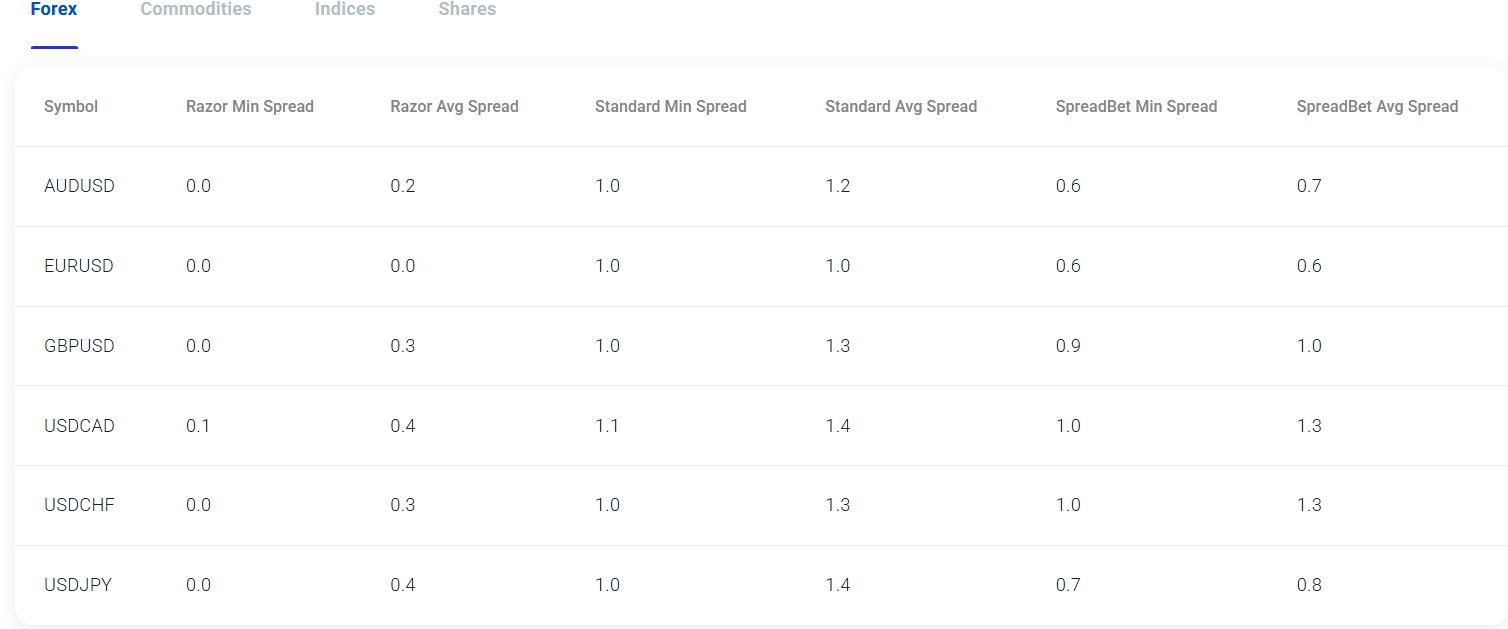

FP Markets is renowned for its raw account model that delivers exceptionally tight spreads on major pairs and rapid order execution.

Features:

- Ultra-tight raw account spreads averaging around 0.6 pips on major currency pairs.

- Advanced order execution with high liquidity and support for multiple trading platforms.

- Transparent fee structure with detailed cost analytics integrated into the trading interface.

Drawbacks:

- Spread variability can occur during periods of heightened market volatility.

- Commission fees may impact overall profitability for traders with lower trading volumes.

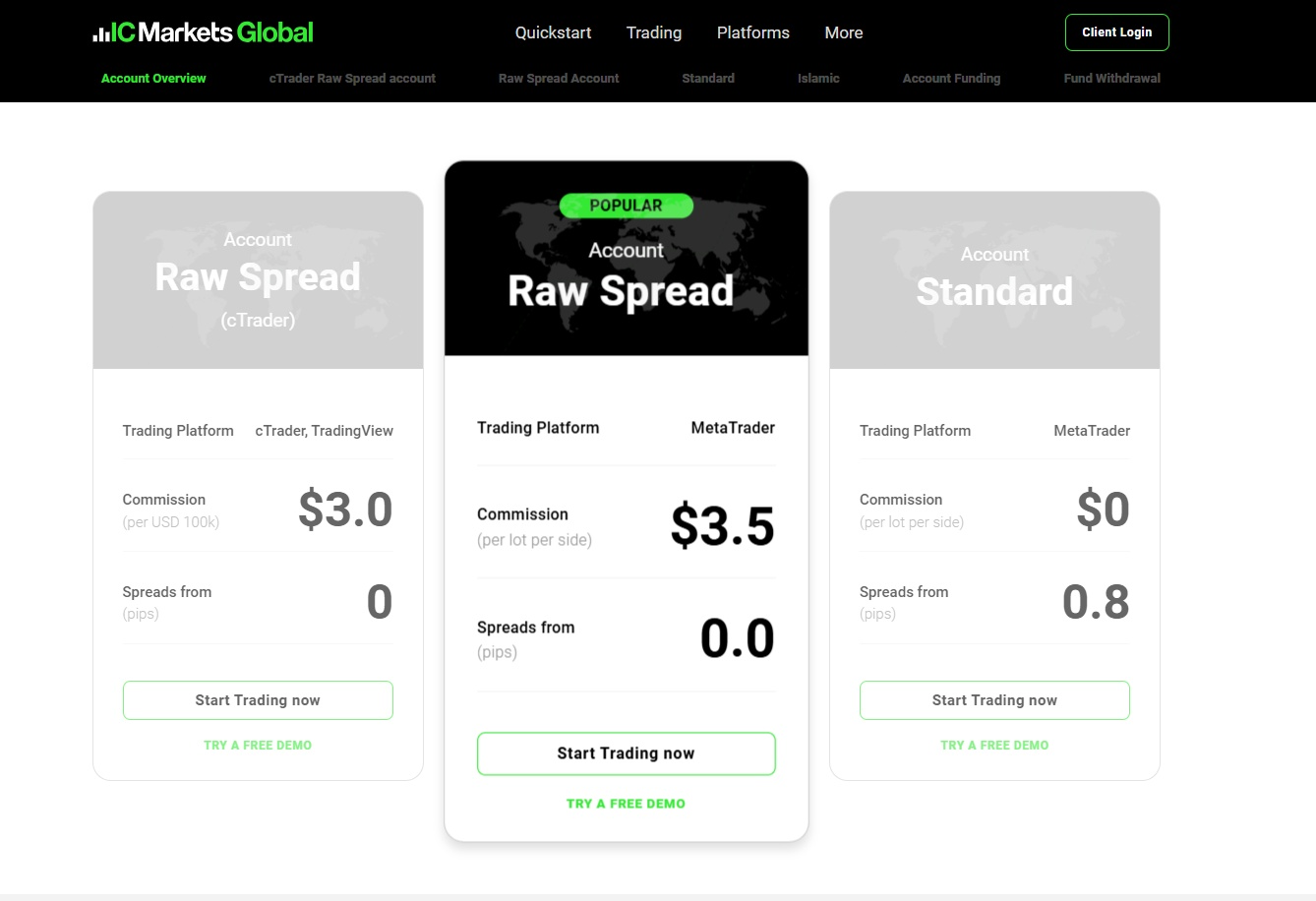

IC Markets

IC Markets is acclaimed for its ECN model, which combines near-zero raw spreads with competitive commission fees, ideal for algorithmic and high-frequency trading.

Features:

- Ultra-low spreads on raw accounts, often approaching 0.0 pips when combined with a low commission structure.

- High-speed execution powered by direct market access and advanced order-routing technology.

- Multiple trading platform options, including popular standards and robust API integration for custom solutions.

Drawbacks:

- The commission-based pricing structure can lead to variable costs, particularly under stressful market conditions.

- Increased fees during periods of market stress may affect the overall cost efficiency for some trading strategies.

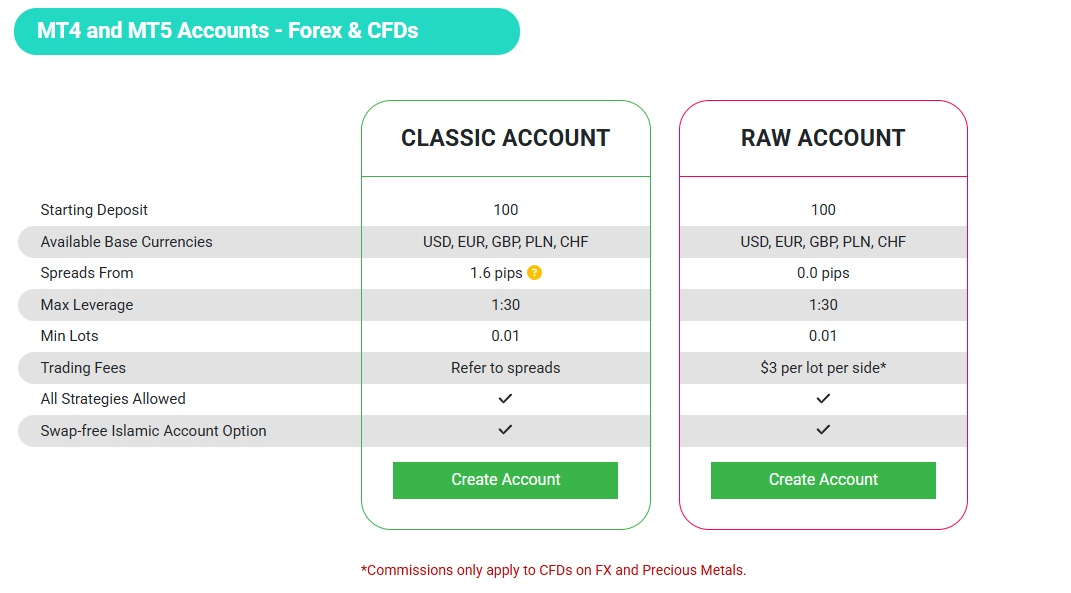

Tickmill

Tickmill stands out with its raw account offerings that provide minimal spreads paired with a modest commission fee, making it a strong choice for high-volume and algorithmic traders.

Features:

- Raw accounts offer spreads as low as 0.0 pips with competitive commission rates, favoring frequent trade execution.

- Optimized for low latency and fast order execution, critical for high-frequency trading strategies.

- Simple and transparent cost structure that facilitates accurate real-time forex spread comparisons.

Drawbacks:

- The commission-based model may not be as advantageous for traders with lower trade volumes.

- A more limited range of account types compared to some larger brokers may restrict flexibility for certain strategies.

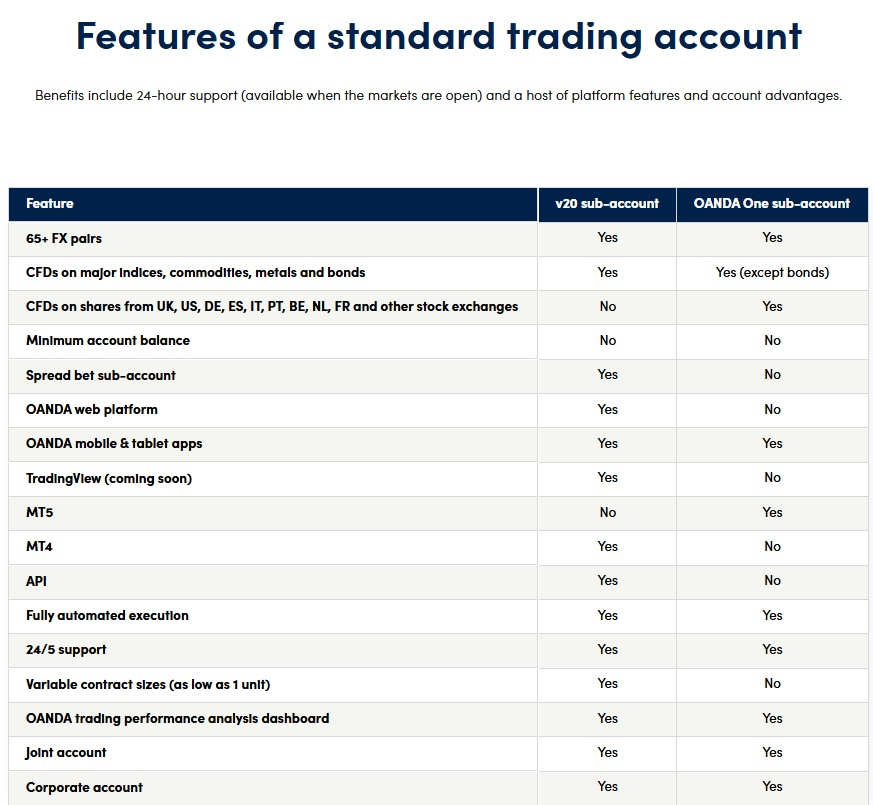

OANDA

OANDA is known for its clear and transparent pricing model, offering consistent spreads and robust multi-platform support for a reliable trading experience.

Features:

- Consistently narrow spreads, with major pairs often trading at around 0.6 pips on average.

- A comprehensive suite of trading platforms, including a proprietary web-based system and mobile apps for flexible trading.

- A fee structure free of hidden charges so that all trading costs are clear and predictable.

Drawbacks:

- Spreads can widen during periods of increased market volatility, potentially raising entry costs.

- Higher trading costs may be incurred on less liquid currency pairs compared to the major pairs.

Pepperstone

Pepperstone delivers competitive spread pricing through dual account models, boasting consistently low spreads during peak market hours alongside advanced risk management tools.

Features:

- Both standard and ECN account models offer reliably narrow spreads, maintaining cost efficiency during high-volume periods.

- State-of-the-art trading platforms characterized by low latency and advanced charting capabilities for real-time monitoring.

- Transparent fee structure with clearly defined commission and spread parameters, enabling effective cost management.

Drawbacks:

- Slight limitations in spread tightness may occur during extreme market volatility.

- Commission fees in ECN accounts can add to overall trading costs for traders with lower volumes.

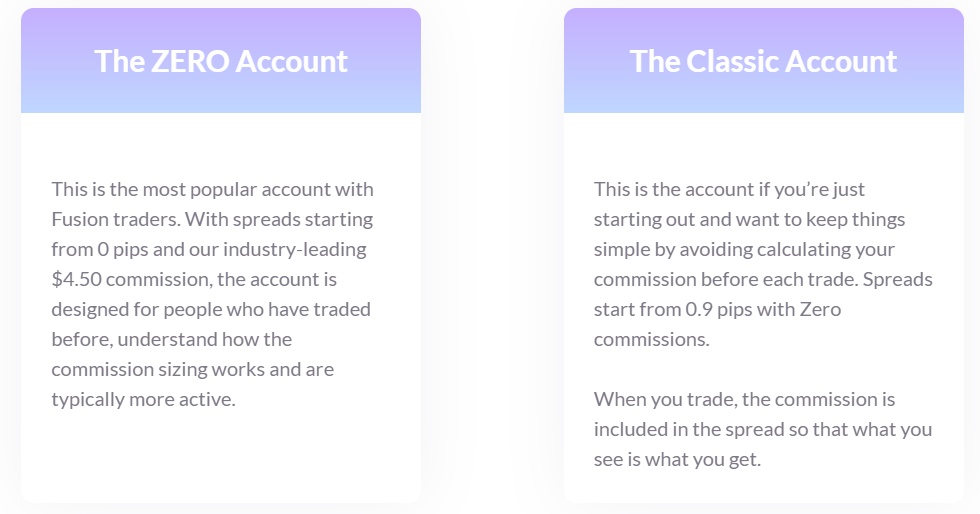

Fusion Markets

Fusion Markets offers near-zero spread accounts that rely on a fixed commission model, making them particularly attractive for high-frequency traders seeking predictable costs.

Features:

- Near-zero spreads paired with a fixed commission structure, allowing for highly predictable per-trade costs.

- Fast order execution supported by advanced technological infrastructure and integrated analytical tools for real-time monitoring.

- Ideal for algorithmic and high-volume trading due to its stable and transparent cost model.

Drawbacks:

- The fixed commission model may result in higher per-trade costs for traders with lower trading volumes.

- A comparatively limited range of platform options may constrain traders seeking extensive customization.

Potential Risks and Considerations with Low Spread Accounts

While the lowest-spread brokers offer significant benefits, traders must remain alert to hidden fees, market conditions, and execution risks. Here’s what to look out for:

- Hidden Fees:

Even when brokers offer extremely narrow or zero spreads, they may impose additional commissions or fees—especially during periods of high market volatility—which can lead to unexpectedly high costs per trade. - Liquidity Issues:

In stable market conditions, spreads remain consistently narrow; however, during major economic events or unforeseen geopolitical developments, even brokers known for low spreads may experience temporary widening and slippage, adversely affecting order execution. - Commission Structure Variability:

The commission-based model of raw accounts requires careful scrutiny. If the commission structure is not entirely transparent or changes without notice, the overall cost-effectiveness can diminish quickly. - Technical Glitches:

Advanced forex software and high-speed trading platforms offer significant advantages, yet technical glitches, execution delays, or discrepancies in data feeds can have a notable impact on performance—particularly for high-frequency and algorithmic traders. - Regulatory and Risk Management Concerns:

Although narrow spreads are attractive, brokers must adhere to strict regulatory standards and provide reliable risk management features, such as guaranteed stop-loss orders and negative balance protection, to safeguard against extreme market movements.

Since technical glitches and execution delays can significantly impact trading performance, especially for high-frequency and algorithmic traders, we offer a reliable Forex VPS with a 10 Gbps network connection speed and 99.95% uptime, guaranteeing minimal latency and reliable connectivity.

With servers strategically located near major financial hubs, including New York City, London, Frankfurt, Singapore, Luxembourg, Amsterdam, Las Vegas, Miami, Dallas, and Utah, Cloudzy provides flexible payment options such as Bitcoin, Alipay, PayPal, Mastercard, and Visa. Plus, all of Cloudzy’s Forex VPS plans come with pre-installed MetaTrader 4!

Final Thoughts

Selecting the right low-spread forex broker significantly impacts trading efficiency and cost management. Even small reductions in spreads can lead to substantial savings over time. Whether opting for raw spread accounts with minimal commissions or zero-spread accounts with fixed costs, understanding execution models and fee structures is key.

Sophisticated traders rely on high-speed execution platforms, real-time spread monitoring, and advanced comparison methods to refine their strategies. A broker that aligns with your trading style and risk tolerance not only cuts costs but also enhances precision, allowing for smarter, more profitable trades.

If you’re new to Forex trading or just want some practical tips, check out our comprehensive guide!