- What is intraday trading?

- Benefits of intraday trading

- Disadvantages of intraday trading

- Choosing the best intraday strategy: Top 5 recommended

- 3 reasons why intraday trading is recommended for beginners

- What you need to do before you start intraday trading

- Best intraday strategies: manual or automatic trading?

- Conclusion: Final thoughts and advice

- FAQ

Intraday trading, or day trading, is among the most popular and exciting forms of trading. It provides the fastest possible profits and a wealth of trading opportunities almost daily. Day traders often just need a few minutes to make fascinating gains in their accounts while avoiding the risk of holding an open position overnight.

Are you into an active trading style in which you react to current market developments? Are you looking for an exciting trading method suitable for smaller accounts? Welcome to the world of intraday trading! This article will explain what day trading is and explain its features. We will outline the main advantages and disadvantages of intraday trading and discuss the best intraday strategy by looking at the 5 best of them.

We will also talk about the best tips for intraday trading, discuss many different aspects related to intraday trading and try to figure out the most successful intraday strategy, so stay tuned!

What is intraday trading?

As its name suggests, intraday trading is the trading of financial instruments within a single trading day. To put it another way, a trader will open and then close a position on the same day, so he does not leave transactions open overnight. This is an active trading method in which one gambles on smaller price movements. Generally, positions are open for several hours.

In intraday trading, low time frames such as hourly, half-hourly or even minute charts are used. While there are more trading signals in lower time frames, on the other hand, there are also more false signals than on higher time frames like daily or weekly charts, where the signals are more reliable and more clear.

Intraday trading is challenging to master even though it may seem simple at first glance. It is, after all, no different than buying at the bottom and selling at the top. But a trader will soon realize that it simply doesn’t work that way, and this will often only happen after he has already lost his account.

In this article, we will talk about the best tips for intraday trading and discuss many different aspects related to intraday trading and try to figure out the most successful intraday strategy.

Benefits of intraday trading

Day trading might seem like a challenging and risky investment technique. Nevertheless, it also has significant advantages, such as the absence of carryover risk and the possibility of accumulating profits through repeated short-term trading. In the following, we will talk about four benefits of intraday trading.

-

No worries about the overnight risk

The most significant advantage of intraday trading is that there is “no overnight risk. The overnight risk refers to the risk that the market price will crash the following day if you go to bed while holding a position, causing you to suffer a loss, or that you will be automatically closed out and forced to cut your losses in forex trading.

In general, stocks and other financial instruments can only be traded during the daytime when exchanges are open. In contrast, Forex can be traded almost 24 hours a day, 7 days a week.

Since some currencies may be traded late at night or early in the morning, passing the night with a position open carries the risk of large fluctuations in the market price the next morning. With day trading, however, there is no such risk because the position is completed in a single day.

-

Financial efficiency

By building up your profits and investing them in your capital, you can improve your financial efficiency. For example, imagine a situation in which you cannot easily close out a position once held, and you are unable to move your funds as much as you would like. The unique feature of day trading is that you close out the transaction by cutting your losses, whether you are making a profit or a loss.

As transactions are closed on the same day, there are few cases where such a thing can happen. Trades can be made by accumulating small profits, resulting in better capital efficiency. It is also ideal for those who “want to get used to trading quickly” and “want to gain experience” since the number of trades will inevitably increase.

-

Investment diversification

Another benefit of intraday trading is diversification. With diversification, you do not limit yourself to one stock but rather hold several stocks simultaneously. By investing in multiple stocks, even if one stock generates a loss, in some cases, you can achieve an overall positive result because the remaining stocks are still positive.

Furthermore, it is not necessary to constantly buy and sell daily, even though it is called day trading. For instance, if you hold and manage only one stock and find yourself in a situation where you are unsure of the market price of that stock, you will naturally have many days without trading.

Meanwhile, if you diversify your investments across about three stocks or currencies, in some cases, you may find that even if the market for one of them is unstable, the other stocks or currencies may be easy to read. Not only does the number of investments affect the profits and losses from trading, but also your investment style.

The key to successful investing is to have a positive overall balance. When a beginner investor starts intraday trading, it is essential to diversify a small amount of money and remember that it is crucial to limit the risk.

-

More likely to be profitable in a short time

In the case of intraday trading, we often sell at a profit when a stock for which we have placed a new buy order goes up even a little bit. An advantage of day trading is that it is highly capital-efficient, and by taking advantage of this and continually generating profits in a short time, you can eventually turn a large profit. Seeing results immediately can also motivate traders.

In long-term investments, it will take some time before the profits generated can be clearly seen and felt. For this reason, some people may gradually decrease the frequency of checking the status of their investments and ultimately leave it at that.

On the other hand, because day trading is a method of accumulating small profits over a short time, it is easy to realize profits. This also has the added benefit of making it easier to maintain the desire to invest. In the next section, we take a look at the disadvantages of intraday trading before getting down to the best intraday strategy list.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSDisadvantages of intraday trading

While we have discussed the advantages of intraday trading, it is important to remember that there are also disadvantages that we will explain in the following.

-

Higher commissions as compared to other investments

One of the disadvantages of day trading is that it involves more trading commissions than other investment styles. Because day trading is a method of closing a trade in one day, you have to buy and sell, and when you start selling, you have to buy back.

As a result, the number of trades will inevitably increase, and the commissions will be higher. The key to compensating for this disadvantage of day trading is to trade with a brokerage firm that charges low commissions.

-

Timing is difficult in intraday trading

In day trading, the time to close a trade is naturally shorter than in medium- to long-term trading. This means that during the course of trading, traders are constantly forced to decide when to sell after buying and when to buy back if they have started by selling. It is difficult to determine the appropriate timing for trading, which is the second disadvantage of day trading.

It is recommended to “not trade when you don’t know the market” to compensate for this disadvantage. Some experience is considered necessary for intraday trading. When you cannot read the market, do not force yourself to place an order but instead use the time to read market information or practice trading with demo trades.

-

Heavy physical and mental stress during trading hours

Because day trading is an investment technique characterized by short-term settlements, traders are constantly faced with the decision to buy or sell during trading hours. This puts a strain on both mind and body during trading hours. We cannot deny the possibility of making emotional decisions if we are under excessive stress.

To prevent this, it is recommended that you establish your own rules for operation when you start day trading. By setting rules in advance, you can reduce the possibility of making errors in judgment even when you are under mental and physical strain. In addition, since day trading does not require you to trade every day, it is acceptable to avoid trading on days when you do not feel you can bear the burden.

Choosing the best intraday strategy: Top 5 recommended

Making a profit in day trading is not simply a matter of completing trades on the same day. An essential aspect of investing as a day trader is to choose the best intraday strategy to trade. The following is a detailed look at the five main strategies for intraday trading.

-

Scalping

Scalping is one best intraday strategy which involves repeatedly buying and selling in a matter of seconds to minutes to accumulate small profits and is one of the most commonly used strategies in Forex.

Advantages of Scalping intraday strategy

- Easy to conclude transactions in a short time and to make profits

- An investment method that provides better mental stability

- Smaller profit results in a smaller loss

- Less likely to get caught up in currency fluctuations

Disadvantages of Scalping intraday strategy

- A high number of trades, so commissions tend to be high

- Wide spreads have a significant impact on profits

- Tend to be significantly affected by the trading environment

While scalping is a strategy for experienced investors, beginners can easily make a profit by following the following tips.

3 tips for successful scalping

In the following, we will share three tips to help you for successful use of the scalping intraday strategy.

-

Be quick to make decisions to cut losses and lock in profits

Since you need to complete multiple trades in a very short time, it is very crucial to quickly make decisions on how to cut losses and lock in profits.

-

Use a brokerage firm that offers low-cost trading

Because you will be repeating transactions often, using a brokerage firm with low commissions is essential.

-

Make sure to check the time frames and currency pairs that are actively traded

Moreover, the possibility of more significant profits will increase if you trade with a good knowledge of the time of day when the Forex market moves sharply.

-

Swing Trading

Swing trading is a short-term investment strategy in which profits are generated by holding positions for a few days to a few weeks, as opposed to scalping, in which trades are made in a few minutes.

Instead of trading with a mid-to-long-term objective, swing traders always make trades when there is a profit from a short-term perspective. Many consider swing trading to be the best intraday trading strategy.

Advantages of swing trading

- There is no need to stick to a screen

- It is easier to generate quicker results than mid-to-long-term investments

- Easier to generate profits even with less volatility in the market price

- Good capital efficiency

- Easier to make a significant profit with a small amount of money

Disadvantages of swing trading

- Possible fluctuations in price after hours

- Difficult to decide when to cut losses

- High commission costs in some cases

Swing trading is a strategy that allows you to easily make large profits with a small number of trades. Because there is no need to keep looking at a computer or smartphone screen all day long, beginners may find it the best intraday strategy to start with.

Nevertheless, checking stock or currency prices daily is essential to ensure that profits are generated.

3 tips for choosing currencies or stocks for swing trading

The following are three tips that will help you turn swing trading into the best intraday strategy.

-

Select stocks or currencies with high liquidity

Choosing stocks or currencies with high liquidity or those that rank high in volume makes it easier to buy and sell at the time you want.

-

Narrow down the number of stocks or currencies to three to five

You should limit the number of stocks or currencies you trade in swing trades to three to five. In this way, you can effortlessly understand the price movements and trade at the appropriate time.

-

Check for uptrends

In addition, do not forget to check for uptrends and make winning trades.

-

Trend Following

Trend following is a so-called “forward-looking” investment strategy in which trades are made according to market trends, for example, buying when the market is in an uptrend and selling when the market is in a downtrend. Trend-following mainly involves trading individual stocks and currencies. While it is not considered to be the best intraday strategy, but it is definitely one of the most popular.

Advantages of Trend Following

- Trading rules are more straightforward to understand

- It is resistant to bubbles and crashes

- Excellent compatibility with stocks and currencies

Disadvantages of Trend Following

- Low win rate

- It is challenging to manage because many stocks or currencies are monitored

- Requires a certain amount of capital

Trend following is an investment strategy with straightforward and easy-to-understand trading rules that can generate sustainable profits over the long term. Moreover, sharp trends can easily be generated when market price fluctuations are extreme, such as during a bubble or a crash. This is considered an excellent time to make a profit.

On the other hand, Trend Following is a strategy that aims to generate significant profits by accumulating small losses. For this reason, it is characterized by a lower win rate than other investment strategies.

In addition, the difficulty of managing a large number of stocks and the need for a certain amount of capital to make a profit are also disadvantages.

-

Mean Reversion

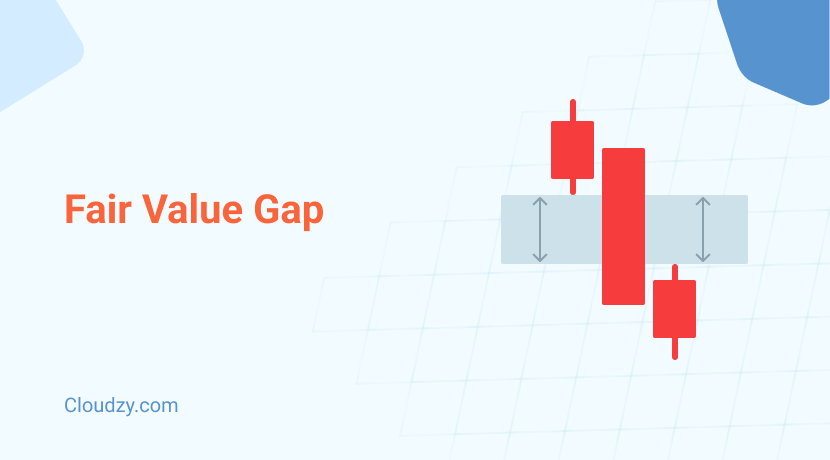

Mean reversion refers to the tendency of a market price to move back to the average after a significant move in the market. Using this Mean Reversion to trade, market situations can be statistically analyzed and used to help you decide your trading strategy.

Advantages of Mean Reversion

- Greater likelihood of high profits

- Suitable for day traders as it is a technique to accumulate small profits

Disadvantages of Mean Reversion

- There is a possibility that the stock price will not return

By opening a position when the stock price crashes, the stock price will likely return to the average someday, making it easy to make a significant profit. Since Mean Reversion is an investment strategy that accumulates small profits, it is recommended for day traders.

But there is a possibility that the stock price may not return when the trend changes, for example. It requires the ability to analyze charts and make good judgments; therefore, gaining experience while actually trading is advisable. In the next section of our article, we will look at money flow in search of the best intraday strategy!

-

Money Flow

Money flow is a term used to indicate the flow of funds moved in the national economy, including the flow of funds involved in private transactions and other activities.

Money flow in investment refers to a strategy that focuses on the flow of money and makes investment decisions using the excitement of the market as a basis. Utilizing a market analysis function called an indicator, the relationship between prices and the number of transactions is represented by a numerical value.

Generally, an indicator value of 80 or higher is considered overbought. In contrast, a value of 20 or lower is deemed as oversold. When oversold, the price has a strong tendency to rise. Consequently, if the value is below 20, it is time to buy the currency instrument. Conversely, if the value exceeds 80, it is time to sell.

While the money flow strategy is a relatively stable investment strategy, it needs the ability to analyze the market in-depth. You should gain experience and determine the right time to buy and sell.

3 reasons why intraday trading is recommended for beginners

Many people may have the impression that day trading is an investment technique with high hurdles for beginners. But there are some points that make it a good choice for beginners, such as the lack of time constraints and the wide variety of tools that can be used to analyze charts and gather information for day trading.

So, intraday trading is definitely worth implementing for beginners; in the next section of our best intraday strategy article, we will list three reasons for this, so check to see if any of them make sense to you.

-

No time restraints

A benefit of day trading is that you are not time-bound. You can focus on your primary job during the day and proceed with strategies, placing orders, and closing deals when you have free time. You can easily balance your investing career and work at the same time.

For example, scalping keeps traders busy with their investments as they repeatedly make trades within a few seconds to a few minutes. But in reality, you do not have to watch the market all day long. It is easy to buy something whenever you want and sell it off immediately.

-

No need to worry about swap points

Forex has swap points, which are fees due to carry-over, but with day trading, you don’t have to worry about that. By closing your positions in a short time, you will not be affected by the swap. However, if a positive swap continues, carrying over for some time is an option.

Long-term investments and swing traders are likely to be concerned about swap points as they carry over their forex positions. While forex cannot be traded on holidays, any major news during that time can impact the market. However, day traders are free from this pressure because they do not carry over positions.

A day trader only needs to watch the profits and losses generated from the market. This means that they can easily proceed without the influence of swap points due to carry-over.

-

Plenty of tools

The most popular brokerage firms and Forex companies have a wide variety of tools. Having a large number of tools available is an advantage for day traders. It is desirable to do a variety of things on a single site, such as chart analysis and information gathering.

The best investment environment is one where chart analysis and information gathering can be conducted in earnest.

What you need to do before you start intraday trading

You cannot make a profit by trading blindly in the stock and currency market. Before you begin intraday trading, create a trading plan and learn about the risks in advance. So, other than having the best intraday strategy, the following are two things you need to do before you start day trading.

-

Develop a trading plan

You should create a trading plan before starting intraday trading. There are two types of trading plans: “long-term plans,” such as annual or monthly plans, and “short-term plans.”

In a long-term plan, you will determine the general framework of the trades you will make, including the percentage of profit you will aim for in relation to your capital, which market sectors you will focus on, etc.

A short-term or trade-by-trade plan should forecast the point at which you will enter the market, the price movement after entry, and the point at which you will sell.

Because intraday trading is short-term trading, you will essentially use technical analysis to buy and sell. To make a plan for each trade, you will need to have knowledge of technical analysis. For this reason, it is crucial to have some knowledge of technical analysis before you start trading.

-

Learn risk management

In day trading, risk management system is of utmost importance. Have you ever wondered what the win rate is for top professional investors? One might think that because they are professionals, their win rate is relatively high, but it is slightly more than 50%.

Because even the best professional investors have such a high winning rate, to make a total profit, it is essential to make a significant profit when you win and a slight loss when you lose.

To minimize the amount of loss, it is essential to clearly define the rules for cutting losses. Thoroughly manage risk by setting rules that allow you to cut losses automatically, such as always cutting losses when you lose x% and cutting losses when the price moves differently than expected.

Best intraday strategies: manual or automatic trading?

A trading strategy can be executed, either by a trader or by a computer. For the first case, we talk about manual intraday trading strategies, requiring a great deal of skill and discipline.

In the latter case, however, we are talking about automatic intraday trading strategies, which implement trading formulas in automated systems that “create” orders and execute them.

All the systems are combined with online access to markets and information and enable you to use “automated trading systems” and, as a result, have a distinct advantage over that. The choice is up to you now to decide on the best solution.

Conclusion: Final thoughts and advice

From all that has been said up to this point, it seems clear that you need precise techniques to do intraday trading. Based on them, you can set up strategies.

It is also clear that to make intraday trades, you have to position yourself a lot of time in front of the monitor, and therefore while you will be clear-headed and logical at the beginning, you will be less so toward the end of the day. Therefore, limiting your intraday trading sessions and taking appropriate breaks during the day, maybe trying to prioritize the absolute best trades would be good.

To succeed in day trading, besides having the best intraday strategy, you must also have a good VPS. When using automated Forex trading, you must keep your PC running during the entire time the market is moving. However, with a VPS on behalf of your PC, you can run automated Forex trading safely and stably even when your PC is turned off.

At Cloudzy, we offer High-Performance Forex VPS for those interested in intraday trading. We provide several Forex VPS plans but would recommend choosing the 4GB plan at first. The cheapest “2GB plan” will work for running one automated Forex trading; however, if you want to run two or more automated Forex trades, you need to choose a plan with 4GB or more.

Our Forex VPS plans come pre-configured with MT4 or MT5, and with a blazing-fast 1 Gbps internet connection, you can effortlessly run multiple automated Forex trades on our virtual private servers. Plus, with our global server locations, you can choose a VPS closer to your Forex broker for even lower latency and a smoother trading experience.

In this article, to come up with the best intraday strategy, we talked about five different intraday trading strategies which you can choose to start your day trading. What do you think about these strategies? Do you have any questions about how to choose the best option strategy for intraday? Let us know in the comments section below.

FAQ

Can I do intraday trading in Forex?

Yes. Because Forex markets provide a high level of volatility and liquidity coupled with low capital requirements and transaction costs, Forex is a perfect choice for intraday trading.

Which indicator is best for intraday trading?

MFI (Money Flow Index) is one of the best indicators for trading. It generates oversold and overbought signals. This makes it a good option for short-term and swing trading.

Which time frame is best for intraday trading?

In Forex trading, many day traders use different timeframes within 5-minute and 1-hour; however, some intraday traders utilize 4-hours and even daily timeframes.