In forex trading, a liquidity sweep happens as institutional participants push values beyond key thresholds filled by stop-loss positions. The action triggers a chain reaction, sparking sharp movements. Such areas hold heavy buying or selling interest. Once swept, they generate powerful shifts.

Knowing how to spot a liquidity sweep gives you an edge. You’re watching for moments when big institutions make their plays. It provides insight into behavior based on clustering patterns.

Our article covers everything you need: what liquidity sweeps are, how to identify them, proven strategies, plus real examples to help you trade them effectively.

Liquidity in Trading

Liquidity refers to how easily you can buy or sell assets without drastically moving the price. The forex market statistics show that daily global trading volume reached $9.6 trillion in April 2025. Such growth marks a 28% increase from the $7.5 trillion recorded in 2022, making forex the most liquid financial market worldwide.

Liquidity regions are hotspots where positions stack up, typically forming around key support and resistance areas. Traders place stop losses or pending orders at these points. When price hits these regions, it activates a flood of orders, sparking sharp movements. Check out our guide on forex chart patterns to strengthen your chart-reading skills.

What Is a Liquidity Sweep in Forex?

A liquidity sweep happens when institutional participants push prices beyond liquidity regions to trigger clusters of stop-loss and pending orders. This chain reaction generates bursts of activity that cause sharp price swings.

Major institutions use sweeps to enter or exit large positions with minimal slippage by tapping into the momentum from triggered order flow.

Spotting where these regions form, particularly around swing highs and lows where traders park their stops, helps you predict potential sweeps and position yourself to capitalize on the volatility they create.

What Happens After a Liquidity Sweep?

Trapped traders scramble to exit once they realize the breakout failed. Buyside sweep victims bought the high. Sellside sweep victims sold the low. Their panic adds momentum to the reversal.

Price typically establishes a new short-term trend opposite to the sweep direction. The move becomes more directional because one side of the order book got cleared out.

Smart traders enter during this post-sweep phase. Some wait for the price to return to an order block or fair value gap near the swept level. Others watch for a retest from the opposite side as confirmation.

Duration depends on your timeframe. Lower timeframes, like 5-minute or 15-minute charts, see effects lasting hours. Higher timeframes, like 4-hour or daily charts, can influence the price for days or weeks.

Real-World Example: The 2024 Yen Carry Trade Unwind

In late July and early August 2024, the yen carry trade took a major hit. On July 31, 2024, the Bank of Japan unexpectedly raised its benchmark interest rate from around 0.1% to 0.25%, catching traders off guard. This was followed by weaker-than-expected U.S. employment data on August 2, which showed only 114,000 jobs added instead of the anticipated 175,000.

These two events triggered rapid reversals. On August 5, 2024, the Nikkei 225 plunged 12.4% in a single day, its steepest drop since 1987. Meanwhile, the S&P 500 fell 3%. Participants who had borrowed yen at ultra-low rates to invest in higher-yielding assets suddenly found themselves caught in a vicious cycle.

This provided a perfect example of how liquidity sweeps can shake up global markets when institutional entities rush to exit positions simultaneously.

Events like these show why execution speed matters in sweep trading. When institutions trigger stop clusters, prices move within seconds. You need infrastructure that won’t lag during these moments.

At Cloudzy, our MT5 VPS features 99.95% uptime, network connections up to 40 Gbps, plus proximity to broker locations across 16+ global spots. Affordable rates make it accessible for sweep traders who need split-second execution.

However, infrastructure doesn’t really matter if you’re not able to identify these liquidity areas where the price might reverse or continue moving. That’s exactly what we cover next.

Liquidity Sweep vs Liquidity Grab

So, what is liquidity sweep in trading compared to a liquidity grab? A sweep is like a big wave that pushes through a whole area full of orders. It activates a bunch of buy or sell stops across multiple levels. It doesn’t just tap in and bounce. It hangs around, consolidates a bit, then eventually makes its shift in the opposite direction.

Now, a liquidity grab is quicker and more focused. Picture it as a quick jab. The market pushes slightly above or below a key level, activates some stops or orders, then snaps right back. You’ll spot a grab by those candles featuring a long wick and tiny body, like a Dragonfly Doji or Gravestone Doji.

The time element matters here. A liquidity sweep can involve several candles and may include a brief consolidation period above or below the threshold before reversing. It gives it a more deliberate appearance on price graphs. A grab happens within a single candle or at most two to three candles. It’s a rapid in-and-out move.

Basically, a sweep gives you more time to see things unfold and plan an entry. Meanwhile, a liquidity grab is a blink-and-you-miss-it move. Spotting whether it’s a sweep or a grab determines the entries and exits in your liquidity sweep trading strategy.

Mastering these distinctions represents one of many skills covered in learning how to become a forex trader, as understanding institutional behavior separates successful participants from those who repeatedly fall victim to stop hunts.

What are Buyside and Sellside Liquidity Sweeps?

Institutional players don’t sweep liquidity randomly. They target specific zones based on where retail traders cluster their stops. These zones fall into two categories, each requiring a different trading approach.

The table below breaks down how to distinguish between them. After that, we’ll walk through each type and how to trade them when they appear on your charts.

Buyside vs Sellside: Quick Reference

Understanding the distinction between these two types of liquidity is important for identifying trading opportunities.

| Feature | Buyside Liquidity | Sellside Liquidity |

| Location | Above swing highs and resistance | Below swing lows and support |

| Stop Orders | Buy stops from short participants | Sell stops from long traders |

| Price Movement | Sharp move upward, then reversal down | Sharp move downward, then reversal up |

| Candle Pattern | Long upper wick (rejection at top) | Long lower wick (rejection at the bottom) |

| Trapped Traders | Breakout buyers | Breakout sellers |

| Common Levels | Equal highs, previous highs, round numbers | Equal lows, previous lows, round numbers |

Buyside Liquidity Sweep

Buyside liquidity sits above swing highs and resistance areas in which short participants place protective stop-loss positions. Such sweeps most frequently occur during the London session open (8:00 AM GMT) and New York session open (1:00 PM GMT), as liquidity surges, and retail orders become vulnerable.

Institutions push prices above these levels to trigger buy stops, creating a cascade of market buy positions. Volume spikes initially as stops activate, but then rapidly declines during the reversal. This volume pattern distinguishes sweeps from genuine breakouts, which maintain or increase volume.

Watch for footprint chart patterns showing rapid candle formation, creating a “fence” or “accordion” appearance, accompanied by volume spikes. Such signals confirm spread expansion from triggered stop clusters, giving you real-time sweep confirmation.

Sellside Liquidity Sweep

Sellside liquidity accumulates below swing lows and support areas in which long participants place protective stop-loss positions. As institutions target such regions, they push prices downward to activate clustered sell stops, converting them into market sell positions that fuel downward momentum.

The Asian session often sets up sellside sweeps. Institutions grab liquidity during quiet Asian trading hours (lower volume periods), then execute the main directional move during London or New York sessions. This timing strategy exploits the predictable placement of overnight stops.

High-impact news releases amplify sellside sweep opportunities. Major economic announcements like Non-Farm Payroll (NFP), central bank decisions, or GDP reports create volatility spikes that institutions use to push past support areas. The combination of news-driven momentum and stop-loss clusters generates powerful sweep conditions.

Confirmation comes through market structure analysis. After sweeping sellside liquidity, watch for upward waves losing momentum on lower timeframes, followed by strong bullish rejection candles like dragonfly doji or hammer patterns with long lower wicks and small bodies.

What Does the Liquidity Sweep Pattern Look Like?

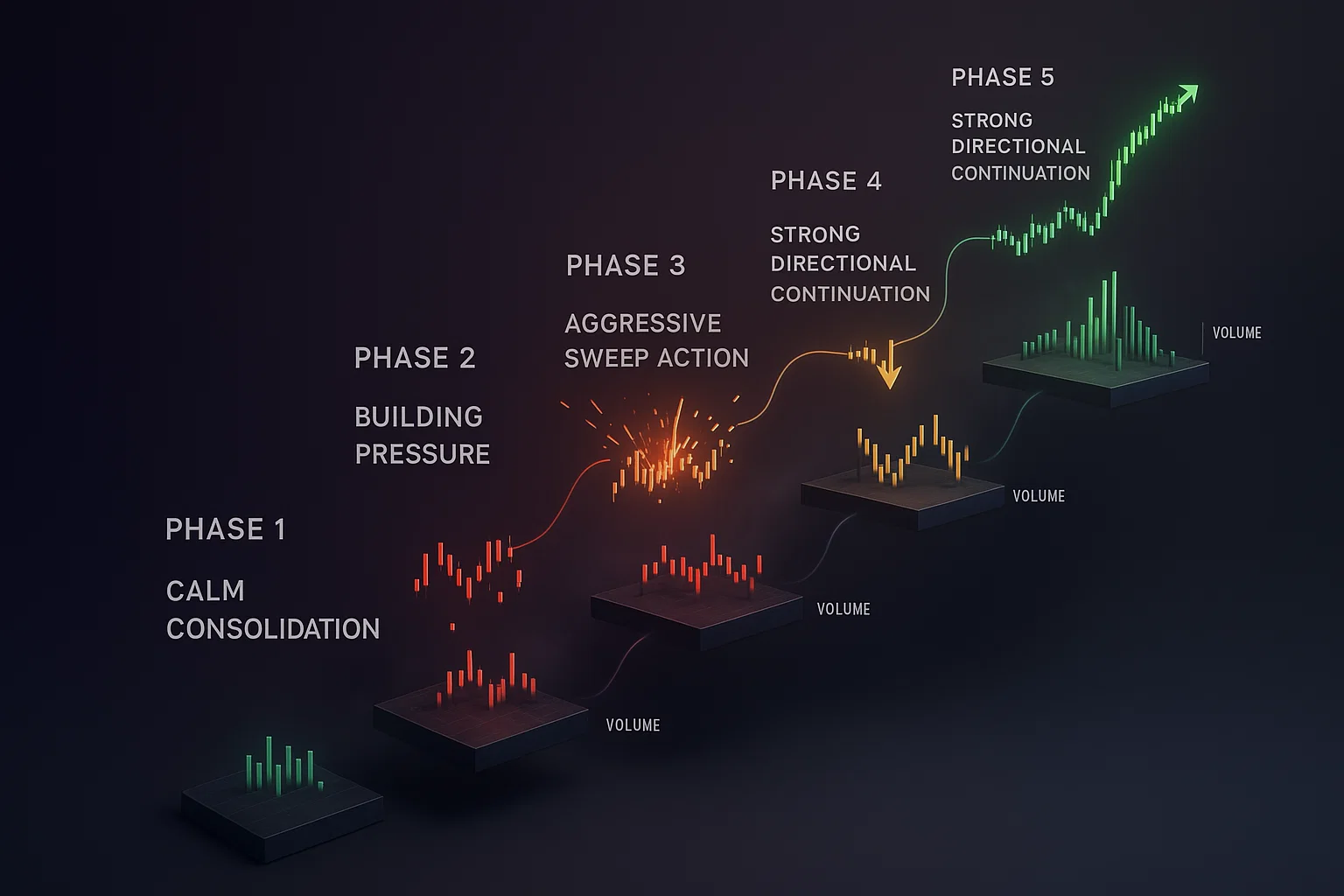

The liquidity sweep pattern follows a predictable five-phase sequence that smart traders use to time their entries with precision.

Phase 1: Consolidation

Price builds up near a key level, creating equal highs or lows where retail participants stack stop-loss positions. This accumulation period can last hours or days, depending on the timeframe. The longer the consolidation, the more stops accumulate slightly beyond the threshold.

Phase 2: Pre-Sweep Setup

Multiple failed attempts to break the threshold build trader confidence. Each rejection encourages more traders to add positions with stops slightly beyond the threshold. Market makers observe this buildup, identifying the perfect liquidity pool to target. Order flow shows increasing activity near the key level.

Phase 3: The Sweep

Price aggressively breaks past the threshold with momentum. Volume spikes as stops trigger and convert to market positions. Breakout traders jump in, thinking they’re catching a new trend. This phase happens quickly, often within one to three candles, creating the illusion of a genuine breakout.

Phase 4: Reversal

Within one to several candles, the price snaps back through the threshold. The wick formation becomes visible on price graphs. A reversal candle confirms the trap. Volume often spikes again as institutions enter their planned positions and trapped traders scramble to exit.

Phase 5: Continuation

After sweeping liquidity and reversing, the price typically moves strongly in the true direction. This move can be substantial because it has momentum from both trapped traders closing positions and institutions entering large orders. The cleared order book offers less resistance to the directional move.

Strategies for Trading Liquidity Sweeps

If you’re familiar with spotting liquidity areas, you’re already a step ahead. The idea is to identify these sweeps as they happen and capitalize on the reversals or breakouts they often create. A solid liquidity sweep trading strategy combines technical analysis, timing, and disciplined risk management.

How to Spot Liquidity Sweeps

To nail down a liquidity sweep, you need to know where to look. Start by marking buy-side and sell-side liquidity levels on price graphs. These are the hotspots in which positions pile up.

Tools like heatmaps or order flow indicators, such as Bookmap or Sierra Chart, show you exactly where orders are stacking up in real time, so you can see liquidity building before the sweep happens.

Success starts with identifying the right levels. Focus on these areas in which liquidity naturally accumulates.

Key Levels to Mark:

Focus on these critical areas in which liquidity typically accumulates:

- Equal highs and equal lows (multiple touches at the same level)

- Swing highs and swing lows from recent price action

- Previous day, week, and month highs and lows

- Psychological round numbers (1.1000, 1.2000, etc.)

- Areas where the price was previously consolidated

Reading Institutional Footprints:

Big institutions often manipulate such regions to shake out retail participants. It’s not personal. It’s just how they move large positions. Watch for sudden spikes in volume or rapid wicks in these areas, and you’ll start spotting their fingerprints.

Equal highs and equal lows are particularly important because multiple touches at the same level create obvious stop-loss clusters.

Having a reliable trading infrastructure helps you catch these moves in real-time. Check out our article on the Best Forex VPS Providers to find solutions that keep you connected during critical market moments.

Trend Reversal Strategy

In a trend reversal strategy, the market signals a major reversal before flipping the script. As the market dips to a point, sweeping stops or activating pending positions, it often snaps back in the opposite direction. This is your moment to jump in.

Use Wyckoff’s theory of accumulation and distribution to see if the market is setting up for a reversal. For example, after a sweep, watch for divergence on the RSI or MACD. If the market is falling but your indicator is rising, it’s a classic sign that the trend is about to turn.

Say the market sweeps below a support zone, forming a bullish pin bar. Couple that featuring an oversold RSI, and you have a solid signal to go long. Just remember to set a stop-loss below the area to keep things tight.

Patience becomes your greatest asset. Wait for the sweep to complete and for reversal confirmation before entering. Rushing in too early often results in getting caught in the initial volatility spike before the true reversal begins.

Breakout Strategy

Sometimes, the market doesn’t reverse. Instead, it blasts right through, leaving those stops in its dust. That’s when a breakout strategy comes into play. Volume is the answer to distinguishing real breakouts from fake ones. High-volume breakouts tend to hold, while low-volume ones often fizzle out.

Advanced tip: Instead of diving in right after the breakout, wait for a retest of the threshold. For example, if the market breaks past resistance, watch to see if it comes back down to test that same level as support. If it holds, that’s your cue to enter.

In an uptrend, the market sweeps above a resistance zone and keeps climbing. The key is to enter slightly above the breakout level, featuring a tight stop slightly below. In doing so, you ride the wave while keeping your risk in check.

Strong closes beyond the threshold, and increasing volume confirm the breakout is genuine rather than another trap.

Multi-Timeframe Analysis

Use higher timeframes for the big picture, then zoom in for precise entries. Use the daily chart to find major liquidity regions, then drop to the 1-hour or 15-minute chart to fine-tune timing.

This works because higher timeframes reveal the key thresholds that major institutions target. Lower timeframes help you spot reversal or breakout patterns in real time. The daily or 4-hour chart shows which levels matter, while the 15-minute or 5-minute chart shows optimal entry timing.

Risk Management

Liquidity sweeps are volatile. Always use stop losses based on ATR (Average True Range) to adapt to market volatility. Use a position size calculator to risk the same percentage (1-2%) on every trade, keeping emotions in check.

A well-placed stop-loss and proper position sizing protect you from bigger losses when markets whipsaw. For more on managing risks effectively, explore our insights on MT4 risk management.

Identifying Fakeouts

Sometimes, price will look like it’s breaking out of a liquidity zone only to reverse sharply back into it. This is called a fakeout, and it’s common in liquidity sweep trading. To avoid getting caught in a fakeout, wait for a solid close beyond the area before entering.

Checking volume can also help. Real breakouts tend to have higher volume, while fakeouts may show a lack of follow-through. If the market breaks above a resistance level with low volume and no strong close above the area, it could be a fakeout. Waiting for confirmation before entering can save you from potential losses.

Look for these warning signs: weak volume on the breakout, no strong reversal candles after the sweep, and multiple rapid wicks in both directions. Also, watch for breakouts happening during low-liquidity sessions like the Asian session. These commonly signal a fakeout rather than a genuine move.

The Confluence Factor

Confluence is your secret weapon. When a liquidity zone aligns with a Fibonacci retracement level or trendline, the odds stack in your favor. Combine harmonic patterns like Gartley or Bat with liquidity regions for high-probability setups.

Watch for liquidity sweeps around major economic announcements (NFP, central bank decisions, GDP reports) when volume spikes unpredictably. Both events can amplify sweep impacts dramatically.

A Liquidity Sweep Example Scenario

Imagine you’re trading EUR/USD during the overlap of the London and New York sessions, as liquidity is at its peak. You notice a liquidity zone forming slightly below a key support level at 1.0850.

The price dips sharply into the area, dropping to 1.0845, triggering stops and activating pending positions. This is a classic move. The price doesn’t just bounce; it forms a bullish pin bar featuring a long lower wick, showing strong rejection of lower prices. Additionally, the RSI is showing oversold conditions below 30, and you notice a bullish divergence forming.

That’s an entry signal for a reversal. You enter long at 1.0855, slightly above the pin bar close. You set a stop-loss at 1.0840, slightly below the wick low and the swept zone. This keeps things tight. Your target is the previous resistance level at 1.0900, giving you a risk-reward ratio of about 1:3.

Over the next few hours, the price climbs steadily. As predicted, it reaches the target at 1.0900, and you close the trade featuring a clean profit. The result? A profitable trade riding the wave created by the market’s major institutions. Such an example shows how combining liquidity sweep identification with technical confirmation creates high-probability setups.

Tips, Tools, and Indicators for Successful Liquidity Sweep Trading

Trading liquidity sweeps can be rewarding, but it takes the right tools, strategies, and a clear game plan.

Essential Trading Tools

The right tools can make the difference between spotting a sweep in time and missing it entirely.

Volume Analysis:

Volume analysis is a handy tool for spotting potential sweeps. Watch for spikes in trading volume alongside sharp movements. Such a combination commonly signals when major institutions are entering or exiting, activating those classic liquidity sweeps.

Order Flow Indicators:

Order flow indicators offer deeper insights by showing real-time buy and sell positions. Anomalies in order flows (like a heavy cluster of orders at unusual price points) can tip you off to incoming sweeps. Using these tools, you’ll know when the action is building up. Popular platforms offering order flow tools include Bookmap, Sierra Chart, and some advanced features on TradingView.

Trading Discipline

Beyond tools, your mindset and habits determine long-term success.

Avoid Overtrading:

Don’t jump on every sweep you spot. Instead, wait for confirmation and make sure the setup aligns with the analysis. Journal a trade. Write down what you saw, why you entered, and how it played out. Over time, this will help you refine a strategy and spot patterns you might’ve missed.

Track Your Performance:

Keep track of key metrics like win rate on sweep trades versus other setups, average risk-reward ratio, best timeframes for a strategy, and most profitable session times. Such data helps you optimize the approach over time.

Conclusion

Liquidity sweeps represent one of the most powerful concepts in modern forex trading. By understanding how institutional entities hunt stops and manipulate prices around levels, you gain insight into market mechanics that most retail participants miss.

Success doesn’t come from catching every sweep. It comes from developing the patience and discipline to wait for high-probability setups. Remember that liquidity sweeps work best when alongside proper risk management, multi-timeframe analysis, and confluence factors.

Whether you’re trading the reversal after a sweep or the continuation that follows, always wait for confirmation before entering positions. The market will always provide opportunities, so don’t force trades.

As you develop your liquidity sweep trading skills, focus on quality over quantity. One well-executed trade based on a clear sweep pattern is worth more than multiple impulsive entries. Keep learning, stay disciplined, and let the institutional entities show you where they’re moving the market.