What is CFD trading? CFD trading is a method where you speculate on price movements of assets like stocks, forex, and commodities without owning them. You profit or lose based on the difference between opening and closing prices of your contract. This guide covers everything beginners need to know about CFD trading. We’ll explain the basics, risks, benefits, and how to get started safely.

What Is a Contract for Differences (CFD)?

A Contract for Differences (CFD) is a financial agreement between you and a broker. You exchange the difference in an asset’s price between when you open and close the position. Key points about what are CFDs:

A Contract for Differences (CFD) is a financial agreement between you and a broker. You exchange the difference in an asset’s price between when you open and close the position. Key points about what are CFDs:

- You never own the underlying asset

- You only speculate on price movements

- CFDs are derivative products

- They allow both long and short positions

Simple Example: Apple stock trades at $150, and you buy a CFD worth $1,000 (equivalent to 6.67 shares). If Apple rises to $165, you profit $100. However, if Apple falls to $135, you lose $100. The beauty lies in the simplicity – you’re only speculating on price movements without dealing with stock ownership complexities. The CFD meaning in trading is straightforward: profit from price changes without ownership complexity.

Countries Where You Can Trade CFDs

![]() CFD trading is legal in most countries but with important exceptions. Countries Where CFDs Are Legal:

CFD trading is legal in most countries but with important exceptions. Countries Where CFDs Are Legal:

- United Kingdom (FCA regulated)

- Australia (ASIC regulated)

- European Union countries (ESMA regulated)

- Canada, South Africa, Singapore

- Most Asian and African markets

Countries Where CFDs Are Banned:

- United States (SEC/CFTC prohibition)

- Brazil, Belgium (retail restrictions)

- Hong Kong (limited access)

Regulation Impact: Different regulators impose varying leverage limits and protection measures. EU and UK traders have stricter leverage caps but better negative balance protection. Before starting, it’s crucial to understand what is CFD trading regulations in your specific country.

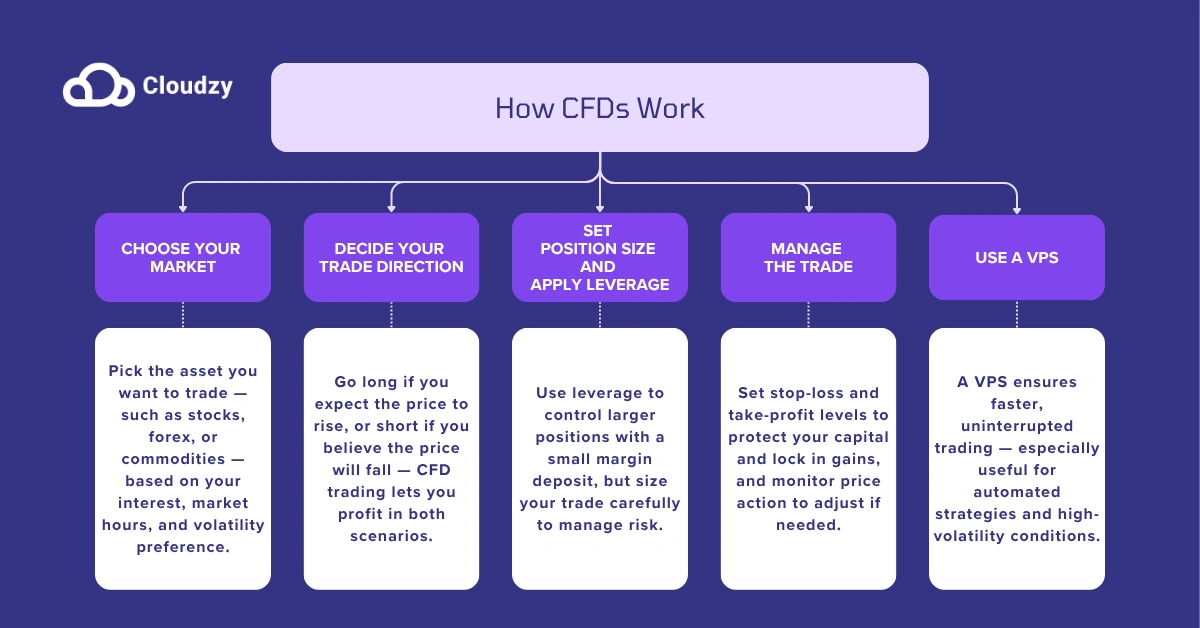

How CFDs Work

CFD trading allows you to profit from price movements of financial instruments like stocks, forex, or commodities — without owning the underlying asset. You trade on margin, using leverage to control larger positions than your actual capital.

Here’s how the trading process works in practice:

Step 1: Choose Your Market

The first step is selecting the financial market that aligns with your interests, risk tolerance, and trading hours.

Markets available for CFD trading include:

-

Stocks (e.g., Tesla, Amazon)

-

Indices (e.g., S&P 500, DAX 40)

-

Forex (e.g., EUR/USD, GBP/JPY)

-

Commodities (e.g., Gold, Crude Oil)

-

Cryptocurrencies (e.g., Bitcoin, Ethereum)

Example: If you’re interested in tech and track earnings reports, stock CFDs like Apple or Nvidia may suit you. If you prefer macro trends and geopolitical moves, forex or oil may offer better trading opportunities.

Step 2: Decide Your Trade Direction (Long or Short)

Once you’ve chosen your market, analyze the price trend using charts or economic news. Then decide if you believe the price will rise or fall.

-

Go long (buy) if you think the asset price will increase.

-

Go short (sell) if you expect the asset price to decline.

Example: If crude oil is trading at $80 and you believe supply cuts will push prices higher, you might open a long CFD. If you think rising inventories will push prices down, you could open a short CFD instead.

This flexibility to profit in both rising and falling markets is a major reason traders choose CFDs.

Step 3: Set Position Size and Apply Leverage

Next, calculate how much of your capital you want to risk, and apply leverage to magnify your exposure. CFD brokers require only a margin deposit — a small percentage of the full trade value.

Common leverage ratios by asset type:

-

Forex (major pairs): 30:1

-

Indices: 20:1

-

Commodities: 10:1

-

Stocks: 5:1

-

Cryptocurrencies: 2:1

Example: Let’s say you want to trade £10,000 worth of the S&P 500 with 20:1 leverage. You only need to deposit £500 as margin. A 1% move in your favor earns you £100 — but the same move against you would cost you £100.

Advanced tip: Always size your position so your stop-loss risk remains under 1–2% of your total account balance, regardless of leverage.

Step 4: Manage the Trade

Once your position is open, the job isn’t done. Monitor price movements and set predefined exit levels.

-

Use stop-loss orders to limit your downside

-

Use take-profit orders to secure gains automatically

-

Be ready to adjust your position based on volatility or news events

Example: You short Tesla at $220 with a stop-loss at $230 and a take-profit at $205. If the stock drops to $205, your trade closes with profit. If it rises to $230, your loss is capped and you’re automatically exited.

Step 5: Use a VPS for Stability and Speed

Many serious CFD traders use a VPS for trading to avoid missed trades due to internet outages or latency.

-

Keeps your trading platform online 24/7

-

Supports automation (e.g., Expert Advisors in MetaTrader)

-

Improves order execution speed, especially during volatile news events

Example: Imagine you’re in a gold trade during a surprise Fed announcement. Price moves $10 in seconds. A VPS ensures your stop-loss or take-profit executes without delay — potentially saving or securing hundreds of dollars.

Key Characteristics of CFDs:

Understanding contract for difference trading requires knowing these essential features:

Leverage Trading: CFDs allow you to control larger positions with smaller capital, amplifying both profits and potential losses. Margin requirements vary by broker and asset, but the principle remains the same – you’re essentially borrowing money to increase your market exposure.

Margin Trading: Every CFD position requires an initial margin (the deposit needed to open a position) and maintenance margin (minimum balance to keep the position open). When your account falls below the maintenance margin requirement, you’ll receive a margin call requiring additional funds.

No Ownership: When trading CFDs, you never actually own the underlying assets. This means you can trade price movements without owning stocks, no dividend rights or voting privileges, and no concerns about storage or delivery of commodities.

Flexible Position Sizes: CFDs offer remarkable flexibility in position sizing. You can trade fractional amounts, start with small positions to test strategies, and scale up as your experience and confidence grow.

24/5 Market Access: Different CFD markets operate on various schedules. Forex CFDs trade around the clock during weekdays, stock CFDs follow their underlying market hours, and indices are often available during extended trading sessions.

Those interested in comparing different trading methods can learn about comparing CFDs vs futures, choosing between CFDs and options, and understanding CFD vs forex differences to determine which instruments suit their goals.

Advantages and Risks of CFD Trading

Learning what CFD trading is involves understanding both opportunities and dangers.

Learning what CFD trading is involves understanding both opportunities and dangers.

Advantages:

Low Capital Requirements:

- Start with $100-500 minimum deposits

- Use leverage to access expensive assets

- Fractional trading available

Market Access:

- Trade global markets from one platform

- Access thousands of instruments

- No geographic restrictions

Profit Opportunities:

- Make money in rising markets (long positions)

- Profit from falling markets (short positions)

- Quick execution and flexible timing

Major Risks:

High Loss Rates: Between 70-80% of retail CFD traders lose money, according to broker disclosures. This isn’t manipulation – it’s leveraged trading reality. Leverage Risks:

- Small market moves create large account impacts

- 5% adverse move with 20:1 leverage = 100% loss

- Margin calls can force position closures

Hidden Costs:

- Overnight financing charges

- Spread costs on entry/exit

- Commission fees vary by broker

Market Volatility:

- Sudden price gaps can exceed stop-losses

- News events create unpredictable movements

- Liquidity issues during market stress

Comparing CFDs vs stocks helps traders understand which approach aligns with their risk tolerance and investment strategy.

How Does a VPS Improve Your CFD Trading Performance?

Virtual Private Servers (VPS) offer significant advantages for serious CFD traders.

Virtual Private Servers (VPS) offer significant advantages for serious CFD traders.

Connection Stability: One of the biggest advantages of using a VPS is eliminating the risk of internet outages affecting your trades. Power failures at your home won’t impact your positions, and you’ll experience reduced latency for faster trade execution. This stability becomes crucial during volatile market periods when every second counts.

Trading Platform Uptime: A VPS keeps your trading software running 24/7, allowing you to execute automated strategies continuously without interruption. You can monitor your positions without being tied to your computer, giving you the freedom to step away while maintaining market exposure.

Speed Advantages: Faster order execution means reduced slippage and better fill prices, especially during volatile market conditions. Lower latency improves your entry and exit timing, which can significantly impact your trading profitability over time.

Professional Setup: VPS provides dedicated resources exclusively for trading, enhanced security for your sensitive trading data, and the ability to access your trading setup remotely from any device. This professional-grade infrastructure helps serious traders maintain consistent performance.

For beginners learning how to trade CFDs, a VPS becomes valuable as trading frequency and complexity increase.

Conclusion

CFD trading offers accessible entry to global markets with minimal capital. However, the high failure rate among retail traders underscores the importance of education and risk management. Key takeaways:

- Start with demo accounts extensively

- Never risk more than you can afford to lose

- Focus on education before live trading

- Understand leverage risks completely

If you’re serious about understanding what CFD trading is, invest time in education before investing money. Consider starting with small positions and gradually building experience. Remember: successful trading requires discipline, continuous learning, and realistic expectations about both profits and losses.