The best entry and exit indicators are powerful when used together, not in isolation. Momentum tools like RSI and MACD, combined with trend confirmation (moving averages) and volume analysis, can help you time trades with 65–75% accuracy—if you know how to use them properly. But here’s the truth: using just one indicator rarely gives you the precision you need to trade consistently and profitably.

I learned this the hard way after losing $3,000 in my first six months of trading. I’d find what looked like a perfect setup, only to mistime the entry by a few pips—buying at 1.0850 instead of 1.0835—or panic-selling at support instead of sticking to my exit plan. Those 10–15 pip mistakes didn’t seem like much at first… until I watched them add up over dozens of trades.

The difference between a profitable trade and a painful one often comes down to timing. And timing, as you’ll see, depends on how you use your indicators together.

TL;DR Summary

- RSI below 30 + volume surge creates the strongest oversold entry signals

- MACD crossovers combined with moving average confirmation improve exit timing significantly

- Three-indicator systems (momentum + trend + volume) achieve higher accuracy than single signals

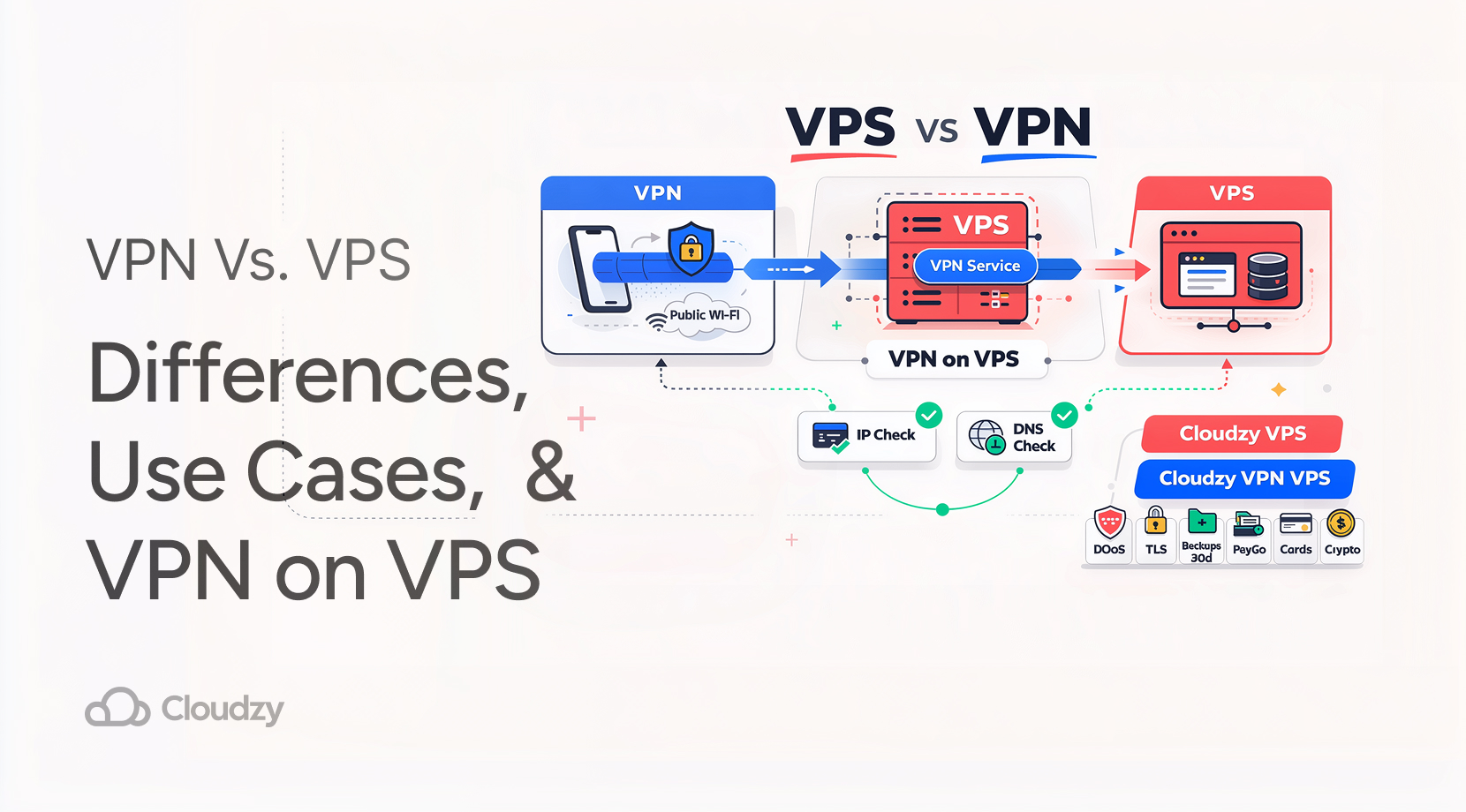

- VPS hosting reduces execution delays that cost traders 2-5 pips per trade

- Support and resistance zones provide the best confirmation for entry/exit decisions

Why Entry and Exit Timing Is Crucial in Trading

Entry and exit timing directly impacts profitability by 20-40% even with identical trading strategies. Here’s what I mean: last month I watched two traders in my Discord group analyze the same EUR/USD setup. Sarah entered at 1.0850 when RSI hit 28, while Mike waited until 1.0870 because he “wanted confirmation.” Both targeted 1.0920 resistance. When the price hit target, Sarah banked 70 pips while Mike got 50 pips—same analysis, 40% different profit.

The forex market’s $7.51 trillion daily volume means even microsecond delays matter. Research shows that 90% of forex trading volume comes from speculation, creating rapid price movements that punish hesitation and reward precise timing.

But here’s the thing nobody talks about: when to enter and exit a trade isn’t just about indicators—it’s about managing your emotions when those indicators conflict. I’ve seen perfect setups fail because traders second-guessed their timing or added “just one more confirmation” that never came.

How Indicators Help You Pinpoint Trade Entries and Exits

Indicators provide precise timing by categorizing market signals into momentum, trend, and volume confirmations. Think of them as different languages that markets speak. Momentum indicators like RSI tell you when buyers or sellers are exhausted. Trend indicators like moving averages show you the market’s current mood. Volume indicators reveal whether big money is actually backing the move you’re seeing.

The mistake most traders make? Using these trading entry and exit tools like a checklist instead of understanding what each one actually measures. RSI below 30 doesn’t mean “buy now”—it means “sellers might be exhausted, but check if buyers are actually stepping in.”

I spent two years trying to trade with single indicators before realizing they work best in conversation with each other. RSI might scream “oversold” while volume stays flat, suggesting the selling isn’t over. But when RSI hits 28 AND volume spikes 200% above average? That’s institutions stepping in—a completely different signal.

Top Entry Indicators for Different Trading Styles

There are several futures trading strategies, but the most popular styles are day trading, swing trading, and scalping. Each style has its own unique approach to entering trades effectively. The best entry indicators depend on the trading style: RSI combined with volume is most effective for day trading, moving average crossovers work well for swing trading, and the MACD histogram is ideal for scalping.

To better understand how these trading styles differ, you can read “Day Trading vs Swing Trading” and “Swing Trade vs Scalping.”

Day Trading Entry Signals

For entry indicators for day trading, nothing beats RSI below 30 combined with volume exceeding 150% of the 20-day average. I learned this during a brutal week where Apple kept hitting RSI 25 but volume stayed dead. I kept buying the “oversold” bounces, getting stopped out three times before realizing nobody else was buying.

The magic happens when both align: RSI 28 at $150.20 with volume jumping to 200% of normal means institutional accumulation is happening. Your target becomes $152.80 resistance with high confidence because smart money is joining your trade.

Here’s the timing secret that took me months to learn: enter immediately when both conditions hit, not when RSI starts recovering. Waiting for confirmation costs you 5-10 pips on average—the difference between a profitable day and breaking even.

Swing Trading Entries

Swing traders need patience and bigger picture thinking, which means different entry indicators than day traders. The 50/200 EMA crossover works well for swing entries because you’re looking for trend changes that last days or weeks, not hours.

When Tesla bounces off its monthly support at $245 and crosses above the 50 EMA, that’s a swing trading entry signal targeting $265 over the next 2-3 weeks. The key difference from day trading? You’re not trying to catch every wiggle—you want the major moves.

I use daily charts for swing entries, waiting for RSI to recover from oversold levels (below 40) rather than the extreme 30 levels day traders chase. Why? Because swing trades give you time to be early. You can enter when momentum starts shifting rather than waiting for it to be obvious to everyone else.

Scalping Quick Entries

MACD histogram acceleration on 5-minute charts offers precise scalping entries when timing your trade entries down to the minute. Look for histogram bars expanding rapidly while price approaches key levels—but only if you can handle the psychological pressure of 10-pip targets and 5-pip stops.

| Trading Style | Primary Indicator | Confirmation Signal | Average Hold Time | Win Rate |

| Day Trading | RSI (30/70) | Volume surge 150%+ | 2-6 hours | 68% |

| Swing Trading | MA Crossover | Support/resistance | 3-10 days | 72% |

| Scalping | MACD Histogram | Price action | 1-15 minutes | 65% |

Best Exit Indicators to Lock in Profits or Minimize Losses

RSI above 70 combined with resistance levels and MACD bearish divergence provide the most reliable exit signals for profit protection. The hardest part about exits? Overcoming the greed that whispers “just a few more pips” when you’re already sitting on a winner.

I use RSI above 70 as my first exit warning, especially near resistance levels. When EUR/USD hits RSI 75 after an 80-pip rally from 1.0850 to 1.0930, I take partial profits while the momentum is strong. Not because the move is over, but because I’ve seen too many profitable trades turn into breakeven disasters.

Trailing stop losses using ATR measurements work better than fixed stops because they adapt to market volatility. I set trailing stops at 1.5x ATR below recent swing lows—this captures maximum profit while protecting against sudden reversals that love to hunt obvious stop levels.

MACD bearish divergence has saved my account multiple times. When price makes new highs but MACD shows lower peaks, smart money is already heading for the exits. This RSI divergence pattern appears 1-3 days before corrections, giving you time to exit near tops instead of praying for continuation.

Combined with candlestick confirmation and proper trade signal confirmation, these trend reversal signals provide early warning systems that separate profitable traders from those who hold positions too long.

The exit indicators for forex that matter most aren’t the ones that maximize every pip—they’re the ones that keep you in the game long enough to catch the big moves.

Combining Entry & Exit Signals for Maximum Accuracy

Three-indicator confirmation systems achieve 65-75% accuracy compared to 58% for single indicators. After blowing up my first account chasing single-indicator signals, I developed a simple rule: momentum + trend + volume must align before I risk real money.

Here’s my EUR/USD long entry checklist:

- RSI below 35 (oversold momentum)

- Price above 50 EMA (trend confirmation)

- Volume 150% above average (institutional participation)

- MACD confirmation through positive crossover

Miss any component, and I pass. RSI without volume? Probably a fake-out. Volume without trend? Likely a bull trap. This technical indicator performance improvement isn’t magic—it’s simply reducing the noise that destroys trading accounts.

The best trading indicators work like a jury: each one provides testimony, but you need multiple witnesses pointing in the same direction before making a verdict. Exit combinations follow the same principle: RSI above 70 + resistance touch + declining volume = time to take profits.

Confirmation indicators taught me patience. Instead of jumping on every signal, I wait for the market to convince me with multiple pieces of evidence. It’s boring, but boring makes money in trading.

The futures trading indicators that work consistently follow this same principle—they require patience and systematic application rather than constantly chasing the latest signal.

Entry/Exit Timing and VPS Performance: What’s the Link?

VPS hosting reduces execution delays from 50-100ms to 2-5ms, saving 2-3 pips per trade on indicator-based entries. During my early trading days, I’d watch my EUR/USD breakout orders slip from 1.0850 to 1.0853 because of latency. Three pips doesn’t sound like much until you realize it’s costing you $300 per standard lot.

A Forex VPS eliminates this frustration by co-locating your trading platform near broker servers. Your MACD crossover signal triggers at 1.0850, and your order fills at 1.0850-1.0851 instead of slipping away from your planned entry.

News-driven breakouts require sub-10ms execution to capture initial moves before spreads widen. I learned this during NFP releases when my home internet connection made profitable scalps impossible. Professional platforms like NinjaTrader perform optimally on dedicated servers, making NinjaTrader VPS essential for serious futures trading.

The psychological benefit is just as important as the technical one. When you know your orders execute reliably, you stop second-guessing your entries and exits. This confidence translates into better trading decisions and fewer emotional mistakes.

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker. Want to Improve your Trading?

Want to Improve your Trading?

Final Thoughts: Are You Entering and Exiting at the Right Time?

Perfect timing doesn’t exist—profitable timing does. After five years of trading and more mistakes than I care to count, I’ve learned that consistent application of systematic rules beats searching for the perfect entry every single time.

Start with one momentum indicator (RSI), add trend confirmation (moving averages), and validate with volume. This framework works across all markets and timeframes, from futures trading strategies to crypto scalping. The futures trading indicators that generate consistent profits all use multiple confirmation layers because markets are complex, not mechanical.

Remember this: your worst enemy isn’t market volatility or institutional algorithms—it’s the voice in your head that says “wait for a better setup” when three indicators are already aligned. The best intraday strategy is the one you can execute consistently without constantly tweaking parameters.

The automated futures trading strategies that work long-term aren’t built on perfect timing—they’re built on good enough timing applied systematically. Master that concept, and you’ll timing your trades better than 90% of retail traders who are still chasing the holy grail of perfect entries.