This question haunts every trader starting their technical analysis journey. I’m sad to say, there’s no single best MT4 indicator. However, after working with hundreds of trading strategies, the best MT4 indicators consistently deliver reliable results: MACD, RSI, Bollinger Bands, and Stochastic Oscillator. These aren’t just popular because everyone uses them; they work because they capture different market behaviors that, when combined intelligently, provide a clearer picture of price action.

TL;DR Summary

- MACD and RSI form the backbone of most profitable strategies – one shows trend changes, the other reveals momentum exhaustion

- Bollinger Bands and Stochastic excel at timing entries when markets get overextended

- Your trading timeline matters more than the indicator – scalpers need different tools than swing traders

- Three indicators maximum – more creates conflicting signals and analysis paralysis

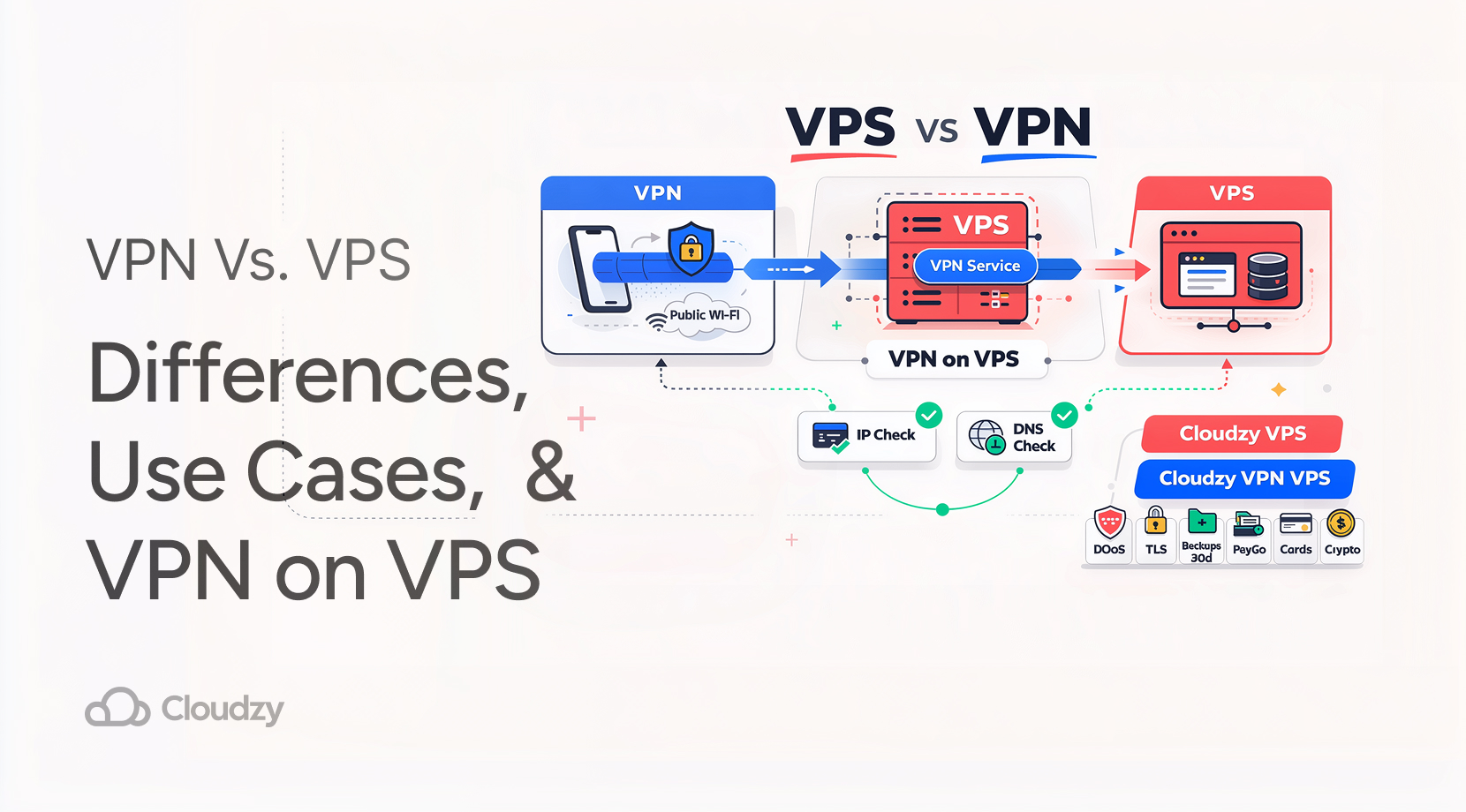

- VPS hosting becomes essential when running multiple indicators or automated systems

What Is MetaTrader 4 (MT4) and Why It’s Still Relevant

Here’s something that surprises many traders: 85% of Forex traders still choose MT4 over newer platforms, even though it launched in 2005. Why? Because when you’re risking real money, you want proven reliability over flashy features.

MT4’s strength lies in its ecosystem – over 2,000 indicators that work together, plus the MQL4 scripting language that lets you build custom strategies. Unlike newer platforms that sometimes feel like they’re solving problems that don’t exist, MT4 focuses on what matters: stable execution and comprehensive analysis tools. This connects perfectly with proven strategies from the broader best trading indicators used across all markets.

The platform’s continued dominance isn’t accidental – it’s the result of thousands of professional traders choosing function over form, especially when their profits depend on consistent performance.

How Indicators Work in MT4

MT4 indicators are mathematical calculations applied to price data, but here’s what most explanations miss: they’re not fortune-telling devices. They’re pattern recognition tools that help you spot recurring market behaviors.

Think of indicators as different lenses for viewing the same market:

- Trend Indicators show you the market’s primary direction (Moving Averages, MACD)

- Momentum Indicators reveal when trends are losing steam (RSI, Stochastic)

- Volatility Indicators measure how much prices are moving (Bollinger Bands, ATR)

- Volume Indicators gauge participation levels (limited in forex due to decentralized structure)

Here’s a crucial point many traders miss: indicators lag behind price action by design. They’re telling you what happened, not what will happen. The skill lies in interpreting these patterns to anticipate likely next moves, which is why combining different indicator types often works better than relying on just one.

The platform updates calculations automatically as new price bars form, but running too many indicators can slow down your analysis and create information overload – a common trap for new traders.

Top 10 MT4 Indicators Traders Actually Use

Based on real trading performance and widespread adoption, here are the best MT4 indicators that consistently prove their worth:

| Indicator | Type | Primary Function | Works Best For | Common Pitfall |

| MACD | Trend/Momentum | Trend changes | All timeframes | False signals in choppy markets |

| RSI | Momentum | Overbought/oversold | Reversal spots | Staying extreme in strong trends |

| Bollinger Bands | Volatility | Price extremes | Range-bound markets | Breakout confusion |

| Stochastic | Momentum | Entry timing | Short-term trades | Whipsaws in trending markets |

| Moving Average | Trend | Direction bias | Trend following | Lag in fast markets |

| ATR | Volatility | Position sizing | Risk management | Not a directional signal |

| Fibonacci Retracement | Support/Resistance | Key levels | Pullback entries | Subjective level selection |

| Parabolic SAR | Trend | Trailing stops | Trending markets | Constant signals in ranges |

| Ichimoku Cloud | Comprehensive | Multiple signals | Complex analysis | Overwhelming for beginners |

| CCI | Momentum | Extreme conditions | Contrarian plays | Similar to RSI issues |

MACD (Moving Average Convergence Divergence) earns its top spot because it catches trend changes early while filtering out minor price noise. When the MACD line crosses above the signal line, it suggests upward momentum is building. But here’s what many guides won’t tell you: MACD works best when the market has clear trends, not during sideways action where it generates countless false signals.

RSI (Relative Strength Index) identifies when prices have moved too far, too fast. Values above 70 typically signal overbought conditions, below 30 suggests oversold. However, experienced traders know that RSI can stay “overbought” for weeks during strong bull runs – the key is using it for timing, not direction.

Bollinger Bands measure volatility by placing bands around a moving average. When prices touch the upper band, it often signals short-term exhaustion, while lower band touches suggest selling pressure is overdone. The critical insight: bands expand during volatile periods and contract during quiet ones, helping you adjust position sizes accordingly.

Stochastic Oscillator compares current prices to recent trading ranges, revealing momentum shifts before they show up in price. Values above 80 suggest overbought conditions, below 20 indicates oversold. The secret sauce: wait for the stochastic lines to cross within these extreme zones rather than trading the zones themselves.

Best MT4 Indicators for Scalping, Swing, and Trend Trading

Your trading timeframe determines which indicators will serve you best, and mixing timeframes often leads to conflicting signals that paralyze decision-making.

Scalping (1-5 minute charts) demands indicators that react quickly to price changes. RSI with a 9-period setting and Stochastic set to 5,3,3 provide rapid signals, but you’ll deal with more false positives. The trade-off is worth it because scalping profits come from speed, not accuracy. Many scalpers also use futures trading indicators for similar rapid-fire setups.

Here’s a reality check: scalping with indicators is tough because by the time your indicator signals, the move might be over. Successful scalpers often combine indicators with price action patterns for confirmation.

Swing trading (4-hour to daily charts) benefits from MACD’s trend-catching ability and Bollinger Bands’ volatility insights. Use MACD with standard 12,26,9 settings on 4-hour charts to catch multi-day moves, while 20-period Bollinger Bands help you time entries when prices get overextended.

The sweet spot for swing traders: wait for MACD crossovers near Bollinger Band extremes. This combination filters out many false signals while catching significant price swings.

Trend trading (daily charts and higher) relies on Moving Averages and MACD for direction, with ATR helping size positions based on volatility. The 50 and 200-period moving averages create a simple but effective trend filter – prices above both suggest uptrend conditions.

Professional trend traders often use a “three-screen” approach: higher timeframe for direction, current timeframe for entry, lower timeframe for precise timing. This prevents the common mistake of fighting the bigger trend.

How to Install and Customize MT4 Indicators

Installing custom indicators involves downloading .ex4 or .mq4 files and placing them in your MT4 indicators folder. Navigate to File > Open Data Folder > MQL4 > Indicators, copy your files there, then restart MT4 to find them in the Navigator panel.

But here’s what the installation guides don’t mention: not all custom indicators are created equal. Some consume excessive computer resources or provide signals that haven’t been properly backtested. Stick with well-known developers and always test on demo accounts first.

For customization, right-click any indicator and select “Properties” to adjust periods, colors, and alert settings. A practical tip: limit yourself to 4-5 indicators per chart maximum. More indicators create visual clutter and often provide conflicting signals that make trading decisions harder, not easier.

If you’re setting up MT4 from scratch, the guide on how to install MT4 on any device covers the complete platform setup process.

Automated Trading on MT4: Indicators That Support Bots

Expert Advisors (EAs) work best with indicators that generate clear numerical values rather than subjective visual patterns. MACD, RSI, and Stochastic fit perfectly because they produce specific numbers that code can evaluate – RSI above 70, MACD line above signal line, etc.

However, automated trading reveals a harsh truth: indicators that work well for discretionary trading often fail in EAs because they lack the human element of market context. A trader might ignore an RSI sell signal during strong news, but an EA will take every signal mechanically.

Most successful EAs combine multiple indicators with additional filters like time of day, volatility levels, or fundamental bias. When building automated strategies with auto trading scripts, features like MT4 close all positions become essential for managing risk when multiple trades trigger simultaneously.

The choice between platforms often comes down to personal preference, though MT4 vs MT5 considerations can help determine which suits your trading style better.

VPS for MT4: Do You Need It for Smooth Execution?

VPS hosting solves real problems that home computers can’t handle reliably. Research demonstrates that latency differences cost traders an average of 1.70 pips per trade – seemingly small until you calculate the yearly impact on larger accounts.

For indicator-heavy strategies, VPS provides consistent computational power without the interruptions of home internet, power outages, or computer updates. This becomes critical when running multiple charts with several indicators each, or when operating automated systems that must respond within milliseconds.

A quality MT4-compatible trading VPS eliminates the technical barriers that can interfere with indicator calculations and trade execution.

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker. Want to Improve your Trading?

Want to Improve your Trading?

Professional traders who’ve migrated to VPS often report that their indicator-based strategies perform more consistently, especially during high-impact news events when home internet connections get stressed.

Final Thoughts: Choosing the Right MT4 Indicators for You

Start with MACD and RSI – they complement each other perfectly by showing trend changes and momentum exhaustion. Add Bollinger Bands when you need volatility context. This three-indicator combination covers trend, momentum, and volatility without creating signal conflicts.

Resist the temptation to add more indicators when trades go wrong. The problem usually isn’t missing information; it’s interpreting the information you already have. Successful trading comes from mastering a few tools rather than collecting many.

Test your combinations on demo accounts, but remember that demo trading can’t replicate the psychological pressure of risking real money. When you’re ready for live trading, choose best MetaTrader 4 brokers that provide reliable execution and proper indicator support.

Most importantly: indicators are tools for analysis, not crystal balls for prediction. They help you make informed decisions based on probability, but markets can and will do unexpected things regardless of what your indicators suggest.