In the field of Forex trading, there is an intrinsic connection between low latency and financial gains. Professional traders value latency because of its impact on Forex trading. It is a critical factor in the performance of their trading strategies.

Low latency is essential for both retail and institutional Forex traders. So we will discuss what forex trading is, then we will answer the question “What is latency?” and how to deal with it.

What does Foreign Exchange mean?

Forex is a decentralized marketplace. In this industry, trading requires handling orders on a global stage. Different currencies come into play, and decisions are made based on an aggregation of clients’ data from the world’s major cities.

Data is collected from all major hubs globally, so there is naturally an inherent latency within this system. Forex traders have fueled technological innovation throughout the IT colocation companies, innovators, and different telecommunication providers. The race is on to drive the fastest transmission of information.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSWhat is Latency and Why Does it Matter?

Simply put, latency is any sort of delay or lapse of time between a request and its response. When it comes to trading, latency directly affects the amount of time it takes a trader to communicate with the market. Latency problems also adversely affect the prompt reception of relevant market information and the ability to act upon its receipt.

The key to long-term profitability is the speed at which traders access information and evaluate the market, then communicate the order to the broker that executes it at the desired price. To ensure that the time taken to complete the entire process is kept to a minimum, low latency connectivity is critical.

The likelihood of a trader gaining a competitive advantage or disadvantage because of latency’s impact on Forex trading has increased as technology-based trading has evolved. As far as the active trader is involved, to optimize the chances of success, latency needs to be evaluated and controlled.

How Does Latency Affect Forex Trading?

One of the common issues when it comes to latency while using market data is known as “data lag“. Data lag is when there are data stream issues or inefficiencies. Many of these issues are totally out of your control as a trader, such as exchange platforms hardware issues and bottlenecks with internet connections.

They can happen without any warning, and they will not be noticed by the trader or anyone controlling the services. When it comes to ordering routing and execution, there can also be several challenges. These are also the situations where latency can have the most significant impact and can be the difference between a successful trade and a bad trade.

Also Read: How to set up VPS for Forex Trading?

What is Slippage?

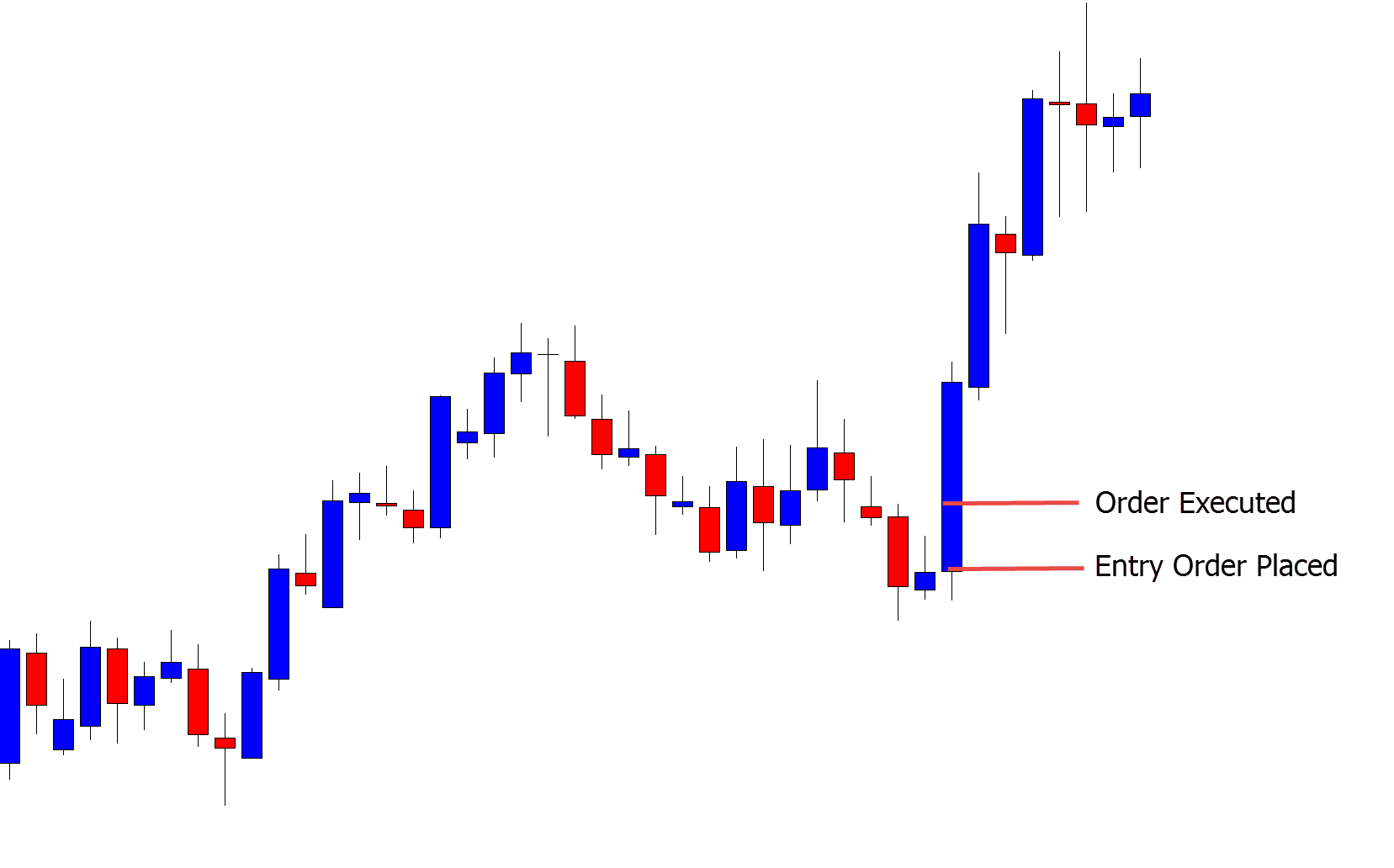

Slippage is a type of latency that defines the price difference between the expected execution of the trade and the price at which the trade is done. Slippage may affect the participants of the retail market. For example, due to the price difference between the time the order was submitted and the time it was performed on the server, market orders (an execution order type designed to fill in at the next available price level) can be executed at prices beyond what the trader expected.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSThe trading hierarchy and order

A successful trading experience depends on reliable order filing, and low slippage on these order fills. All this depends on the data on the market being delivered ahead of the competition.

The general sequence of order and execution goes along the lines of the order is entered remotely on an online trading website by a trader. Then the order is received and relayed by the broker to an exchange or market. The order is then placed in a queue at the exchange or market.

So, this usually’s how it goes:

- A trader enters an order on a trading platform,

- The broker receives an order,

- The broker relays the order to a market,

- The order is placed in a queue.

But there is a chance that latency may trigger some problems in the process during each stage listed above. In this case, the problem with latency is that some form of delay can mean that the order will be filled, but it will be filled at a price other than what it was executed at, so it will give you a much lower opening price than initially planned.

Also Read: 6 best Forex trading Robots

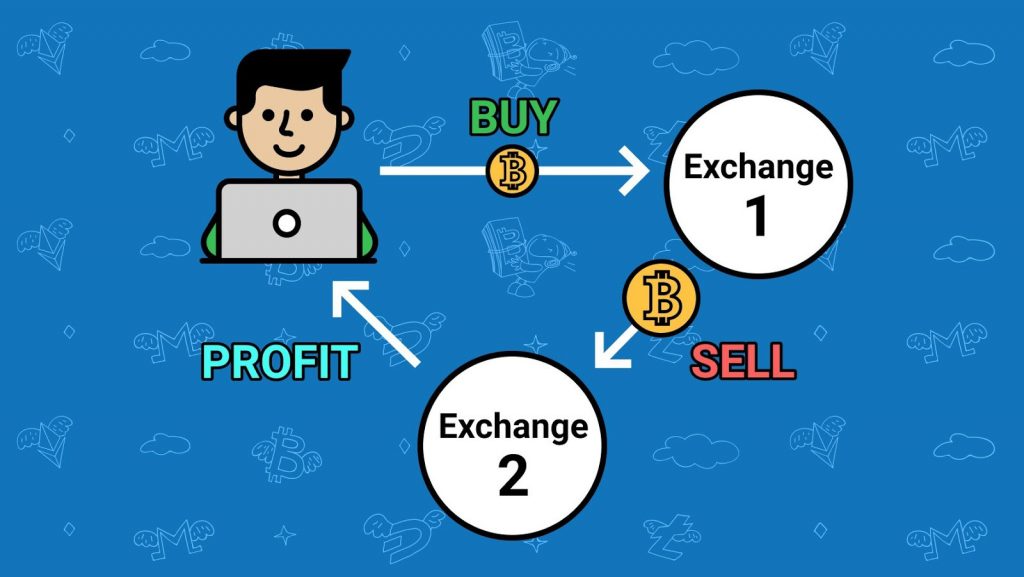

What is Latency Arbitrage?

One of how high-frequency traders benefit to the detriment of slower trading investors is a trading practice known as latency arbitrage. Latency arbitrage is software that provides us with an almost guarantee of efficient trading by catching the imperfections of the slow broker, based on the quotes of the fast broker. It includes arbitration of prices obtained from individual exchanges with low latency in fractions of a second.

Latency Arbitration or Delay Arbitration is focused on the use of imperfections by brokers whose quotations are not in line with the market and visible to other brokers. These occurrences are very unusual and are typically caused by technological variables such as server load, delay in data transfer from the quotation provider, etc.

Of course, it is possible only with the assistance of a machine that compares such dependencies in real-time; here milliseconds are vital. It is possible, however, and there is a chance to raise the advantage on the trader’s side.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSHow Can You Reduce Latency’s Impact on Forex Trading?

Latency can affect trading. It may be the difference between a profitable or lossmaking trade. However, there are a few things you can do to help handle the latency.

Some of these steps include ensuring that you have up-to-date computer hardware that can easily support the execution of the required applications, conduct internet connection checks regularly, and run You should also regularly monitor your trading platform to ensure that there are no lag problems in updating the charts or any other features.

1. Using Direct Market Access

There is something known as DMA that stands for Direct Market Access for more extensive and more institutional businesses, which allows them to skip a variety of different stages of order execution quickly. Via a DMA, the order placed by the trader through a link to an exchange or market.

Then it is placed in a queue ready for execution on the market or exchange. As you can see, already half the processes are done, and so there is far less chance for potential latency to creep in and cause problems. The problem is that as DMA services are quite limited, this does not apply to retail traders.

As technology progresses, more and more brokers are looking to provide retail traders with this kind of service, claiming to provide direct market access. But before it is properly open to retail traders, there are a few things you could try to deal with your latency problems.

2. Using Workstations Designed for Trading

Upgrading the devices used in trading is one way of reducing latency in trading. It may be fashionable to use smartphones and tablets, but the fact is that they are not made for this. Their capabilities for data transmission are not designed to help fast-paced trading. Consumer-grade connectivity adds to latency as well; in some instances, up to one second.

3. Trade in gold

One way to reduce the impact of latency on your trading without getting a Forex VPS is to change the assets you trade in. Gold is a “safe haven” asset that rarely falls in value and is rather stable. Its price moves relatively slowly, so there is much less chance of slippage even if there is high latency in your trading.

4. Using Improved Internet Networks

The use of improved internet access is another strategy. As far as internet access is concerned, 5G networks tend to be the new norm for retail forex trading. If your country still provides 3G, you are out of luck. You can also make do with 4G if you have access to it.

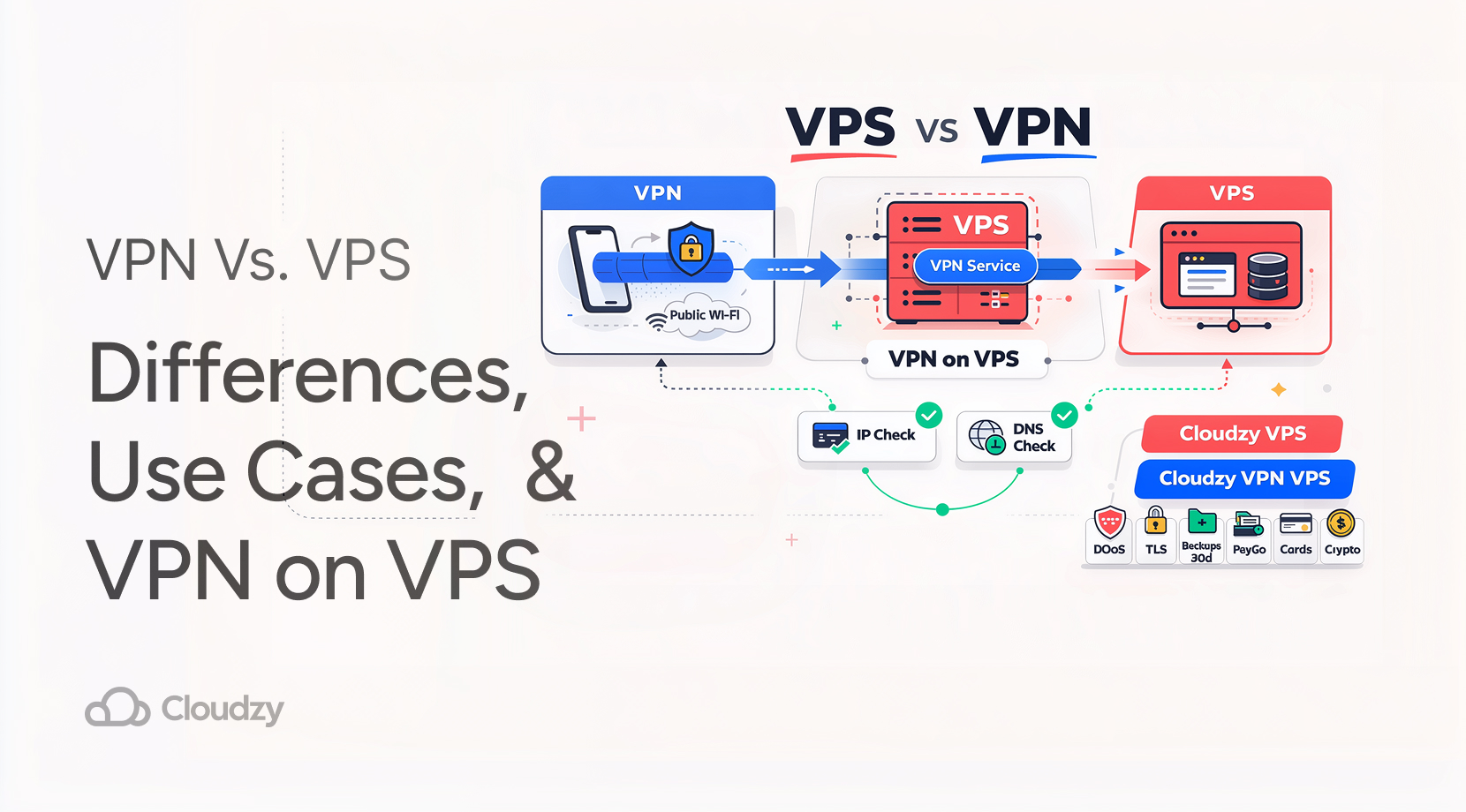

5. Using Virtual Private Servers (VPS) for Forex

The distance between the trader and the broker can influence the efficiency of the trading mechanism. Here is where a VPS (private virtual server) can help a lot. Hypervisor technology allows a server to be divided into several smaller VPS services. This server can host several virtual machines or VPS without performance issues. When you use a VPS for trading, it is usually called a Forex VPS.

A Forex VPS is a remote device on which it is possible to host an expert advisor. The aim is to bring your trade robot as close as possible to the servers of the broker, which minimizes data lag.

Also Read : Run Expert Advisor on MT4

The majority of top brokers support connection to a VPS system. One advantage of using the VPS of the broker over another supplier is that their VPS is often in the same data center as the trading servers. Its disadvantage is usually the higher cost of a broker VPS compared to a normal Forex VPS.

The best Forex VPS brokers in 2022

These days, the positive effect of a minimal latency time on Forex trading is crystal clear for both Forex traders and Forex brokers. As a result, premium Forex brokers became featured with the lowest latency time (less than milliseconds) to attract more and more clients.

Take a Look: Best Forex VPS Provider in 2022

For your consideration, we prepared the below table comparing different features of the world’s most distinguished Forex brokers, including their latencies. Please note that all the brokers in the table provide acceptable latency for Forex. However, according to professional traders, some of them are known to be the best of the best when it comes to latency (most minimal latency).

[table id=best-forex-01 /]

Conclusion

When it comes to Forex trading, latency can be a real challenge, and it is something you want to make sure you do whatever you can to keep it low. It can be the difference between a gain and a loss. So do what you can to minimize it.

If your broker frequently has slippage and latency problems, check your hardware, software, and the internet. You might start searching for a broker that provides marginally better latency. Just make sure you always track what latency and lag you get so that you can be on top of your game.

Before you begin trading, you can run ping tests on your internet connection. Your charting and pricing tools should also be revised. To ensure you get price and news data promptly, you may need to pay for a charting application that is hosted on an advanced high-speed server

One thought on “What is latency? How Does Latency Impact Forex Trading?”

is vps location important for latency?

im moving to usa. do i need a usa vps for forex trading?