Nobody talks about the trader who made $50,000 swing trading last year while working as a nurse. Or the former day trader who switched to swing trading after his third stress-induced panic attack. The internet loves showing you the Ferrari-driving day trader, but that’s survivorship bias talking.

Here’s what I’ve learned after watching hundreds of traders: profitability isn’t about picking the “superior” strategy. It’s about brutal self-honesty regarding your psychology, schedule, and wallet size. Day trading turns you into a market gladiator—exciting but exhausting. Swing trading? More like being a patient sniper.

Both approaches can fund your retirement or bankrupt you. The difference lies in matching strategy to personality, not chasing theoretical returns.

Quick Summary

- Day trading demands $25,000 upfront, full-time attention, targets quick 1-3% gains

- Swing trading starts with modest capital, part-time friendly, hunts bigger 5-15% moves

- Crypto rewards lightning-fast reflexes over patient positioning

- Forex works beautifully for both styles, stocks favor the patient approach

- Infrastructure matters for both, but day traders live or die by execution speed

What Are the Core Differences Between These Approaches?

Day trading closes every position before markets shut down. Swing trading holds positions for days or weeks. This simple timing difference creates completely different lifestyles.

The swing vs day trading choice shapes everything else: your morning routine, stress levels, even relationships. I’ve seen marriages strain under day trading pressure and flourish when couples switched to swing approaches.

Day Trading: Living on Market Time

Day trading feels like running an urgent care clinic during flu season. Constant decisions, immediate consequences, no breaks. You might buy Apple at $175, scalp $2 by lunch, and bank $200 on 100 shares. Repeat 15 times daily.

The Pattern Day Trader rule kicks in after four round trips within five business days. Cross that line and you need $25,000 minimum. Drop below and brokers freeze your account until you deposit more cash.

Here’s the brutal math: earning $250 daily (1% on $25,000) sounds great until you realize you need 55-60% win rates just to break even after commissions. Most people underestimate how mentally exhausting making 50+ decisions daily becomes.

Swing Trading: Patience as Strategy

Swing trading feels like fishing—lots of waiting punctuated by intense action. You research Tesla ahead of earnings, buy at $240, set stops at $225, then wait. Three weeks later it hits $280 and you pocket $4,000 on 100 shares.

Many successful swing traders vs day traders choose this path specifically because it preserves sanity while maintaining profit potential. You’re not chained to charts all day. Check positions during coffee breaks, adjust stops over weekends, sleep peacefully knowing your edge plays out over time.

Capital requirements stay flexible. A $3,000 account targeting 8% gains per trade generates $240 profits. Hit three good setups quarterly and you’re earning decent side income without the cortisol poisoning.

How Do Capital and Risk Requirements Compare?

Understanding whether swing trading vs day trading suits your situation requires examining harsh realities rather than marketing fantasies.

| Factor | Day Trading | Swing Trading |

| Starting Capital | $25,000 (legal minimum) | $1,000+ (your choice) |

| Daily Commitment | 6-8 hours | 20 minutes |

| Monthly Decisions | 100+ | 8-12 |

| Sleep Quality | Often poor | Usually fine |

The PDT rule exists because regulators watched small accounts get slaughtered by high-frequency madness. Below $25,000, you’re limited to three day trades per five-day period—effectively neutering any profit potential.

Swing trading offers breathing room. Risk 2% per trade on a $5,000 account ($100 maximum loss), target 3:1 rewards for $300 potential gains. Win 60% of trades and you slowly compound wealth without requiring therapy.

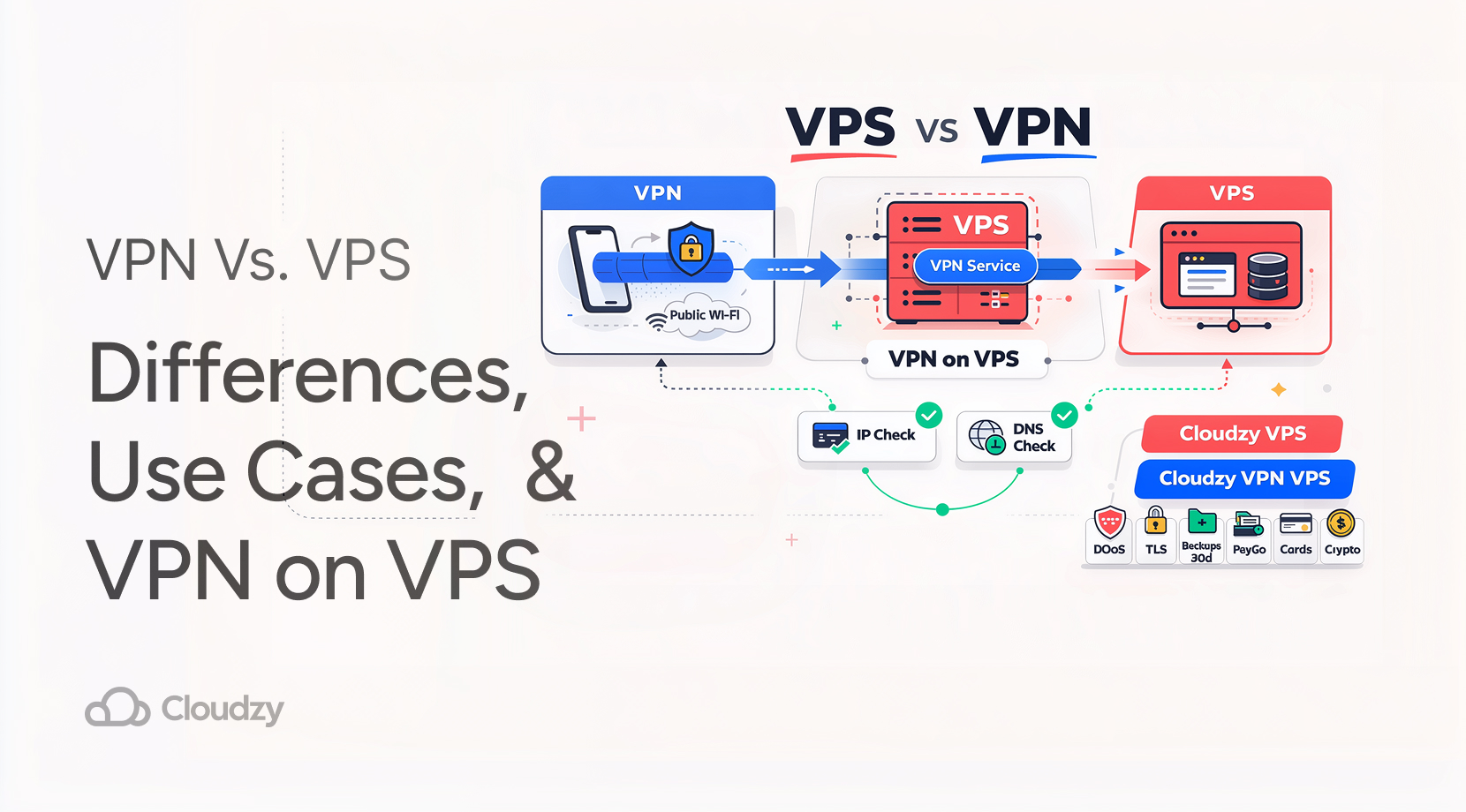

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker. Want to Improve your Trading?

Want to Improve your Trading?

Which Strategy Fits Crypto, Forex, and Stocks Better?

Different asset classes reward different temperaments based on unique behavioral patterns and trading dynamics. Market structure matters more than most people realize.

Crypto: Digital Chaos Rewards Speed

Cryptocurrency markets operate like caffeinated stock markets—everything happens faster and bigger. Bitcoin casually swings 8-12% daily, creating multiple profit windows for quick-thinking traders.

But here’s what most miss: crypto swing trading during major trends can be absolutely devastating to short positions. I watched someone ride Ethereum from $1,200 to $3,800 over six weeks in early 2021. That’s 216% return for doing essentially nothing but holding.

Ethereum VPS hosting becomes non-negotiable during those insane 3 AM price explosions when exchange servers crash and retail traders get liquidated.

Forex: The Professional’s Playground

The forex market churns $7.5 trillion daily through institutional pipes, creating consistent opportunities for both approaches. Major pairs like EUR/USD move predictably during London/New York overlaps.

Swing trading forex captures central bank policy shifts beautifully. When the Fed signals hawkish turns, dollar strength often persists for weeks. Smart swing traders position ahead of these macro shifts rather than fighting them tick by tick.

Stocks: Where Patience Pays

Individual stocks reward swing traders who understand earnings cycles and sector rotations. Companies regularly gap 15-25% on quarterly surprises, rewarding patient position holders over frantic scalpers.

Day trading stocks works with mega-cap names providing consistent intraday ranges. But swing trading captures those magical moments when Netflix announces subscriber growth or Tesla delivers surprising margins.

Profitability Comparison: Beyond the Marketing Hype

The swing trading vs day trading profitability debate misses the real question: which approach allows sustainable execution given your personality and circumstances?

Day trading offers immediate feedback but demands emotional steel. Research shows approximately 97% of day traders who persist beyond 300 days lose money. The successful minority typically earns $100,000-500,000 annually, but this requires treating trading like emergency medicine—intense, demanding, sometimes traumatic.

Swing trading pursues larger gains through patience rather than frequency. Experienced practitioners target 8-15% per position over 2-4 weeks. Complete 20 successful swings annually and you achieve life-changing returns without destroying your nervous system.

Transaction costs quietly murder day trading profits. Frequent trading generates commission expenses that devour 3-6% annually. Swing traders pay these costs maybe 15 times yearly instead of 500+.

What Tools and Technical Approaches Work for Both?

The intraday trading vs swing trading distinction becomes clear when examining tool usage and analytical timeframes.

Day traders live on short-term momentum signals and real-time volume spikes. NinjaTrader VPS ensures millisecond-precise execution when volatility spikes and retail connections fail.

Swing traders focus on daily/weekly trend analysis. The best trading indicators include moving averages, MACD, and RSI adapted for longer timeframes and bigger picture context.

Futures trading indicators demonstrate perfect adaptability across timeframes. Futures trading strategies often combine multiple timeframe analysis for optimal entry timing.

Modern automated futures trading strategies can execute trades regardless of whether you prefer day trading and swing trading approaches, adapting indicators across any timeframe you specify.

Which Strategy Suits Beginners Better?

Swing trading wins decisively for beginners, though not for reasons most expect. When evaluating is swing trading better than day trading for beginners, consider psychological rather than just financial factors.

Swing trading provides time to analyze mistakes without market pressure crushing you. Day trading overwhelms beginners with split-second decisions that amplify emotional errors into account-destroying spirals.

Most beginners start with $2,000-8,000 capital, making swing trading the only realistic choice. Beginning traders should master best intraday strategy concepts through paper trading before risking real money on rapid-fire decisions.

Here’s what nobody mentions: swing trading teaches patience, arguably the most valuable trading skill. Day trading often teaches hyperactivity, which usually proves expensive.

How Infrastructure Affects Both Approaches

VPS hosting reduces execution latency by 50-200 milliseconds compared to home internet. Research indicates that 1ms latency reduction improves execution accuracy by 0.1%—seemingly small but meaningful for active traders over thousands of transactions.

Day traders feel latency pain acutely. Missing fills by 50 milliseconds during volatile breakouts turns winners into losers regularly. Swing traders benefit from reliability more than raw speed, though both matter.

Choosing Your Path Intelligently

Choose day trading if you possess adequate capital, thrive under pressure, and can dedicate full market hours without family obligations suffering. The immediate feedback appeals to action-oriented personalities seeking constant engagement.

Select swing trading if you value work-life balance, have limited starting capital, or prefer building wealth gradually. Extended timeframes suit analytical personalities who prefer thinking over reacting.

People often ask about swing trading vs day trading which is more profitable, but the question misses the point. Profitability comes from matching strategy to personality, not picking the theoretically superior approach.

Many successful traders blend both methods strategically. The intraday vs swing trading choice often becomes irrelevant once you develop genuine market intuition and risk management skills.

Start with swing trading to build foundational skills, then experiment with day trading once you’ve proven consistent profitability over 18+ months. Focus on mastering one approach thoroughly before attempting multiple strategies simultaneously.

One thought on “Day Trading vs Swing Trading: Which Strategy Wins?”

Really appreciate how this post cuts through the hype—especially the point aboutBlog Comment Creation matching strategy to personality. As someone who tried day trading while juggling a full-time job, I quickly realized swing trading suited my lifestyle and stress levels much better. It’s refreshing to see an honest take that goes beyond surface-level comparisons.